Fintech development services are specialized partnerships designed to transform complex financial concepts into secure, scalable, and market-ready software. They are the architects and engineers behind everything from seamless payment gateways and digital lending platforms to sophisticated AI-powered wealth management tools. For any business aiming to innovate in the financial sector, these services are the essential bridge from idea to a compliant product that earns customer trust.

This guide explains why specialized development is critical, the core pillars of a successful fintech product, and how to choose the right technology and delivery model to achieve your business goals.

Why Specialized Fintech Development Matters

Building financial software is fundamentally different from creating a typical application. It requires a strategic team that combines deep financial domain knowledge with high-level engineering expertise. The stakes are exponentially higher; software that moves money demands an obsessive focus on security, regulatory compliance, and transactional integrity from day one. A bug in a social media app is an inconvenience; a similar glitch in a fintech system could compromise user accounts and leak sensitive financial data, causing irreparable brand damage.

The Business Impact of Domain Expertise

Generic development practices are insufficient for the financial world. A specialized fintech partner brings a distinct mindset and skillset, fluent in concepts like transaction reconciliation, liquidity management, and international data residency laws.

This deep expertise delivers tangible business outcomes. An experienced team builds products that are not only innovative but also defensible. They anticipate regulatory hurdles and engineer systems to meet standards like PCI DSS, SOC 2, and GDPR from the outset. This proactive approach prevents costly redesigns and compliance issues, ensuring your product can scale without hitting a regulatory brick wall.

A Market of Rapid Growth and High Stakes

The demand for these specialized services is booming. The global fintech market was valued at USD 340.10 billion in 2024 and is projected to reach USD 1,126.64 billion by 2032, reflecting a compound annual growth rate of 16.2%. North America holds the largest market share at 34%, signaling fierce competition. You can explore the full market analysis on fintech statistics to understand the drivers of this growth.

This expansion puts immense pressure on the underlying technology. Businesses need partners who can deliver robust, resilient solutions capable of handling millions of real-time transactions and integrating with a complex web of third-party systems.

Key Areas of Fintech Development Services

These services cover a wide range of financial technology applications, each with a direct impact on business operations and customer experience.

| Service Area | Core Function | Business Impact |

|---|---|---|

| Payment Solutions | Building secure payment gateways, digital wallets, and processing systems. | Enables seamless and secure transactions, boosting customer trust and revenue. |

| Lending Platforms | Developing automated loan origination, underwriting, and management software. | Accelerates lending decisions, reduces operational risk, and expands market reach. |

| Digital Banking | Creating mobile/web banking apps, core banking systems, and open banking APIs. | Enhances customer experience, streamlines operations, and fosters product innovation. |

| Compliance & RegTech | Integrating KYC/AML verification and automating regulatory reporting. | Ensures adherence to financial laws, preventing fines and reputational damage. |

| WealthTech & InsurTech | Building robo-advisors, portfolio management tools, and digital insurance platforms. | Democratizes access to financial advice and automates complex financial tasks. |

Ultimately, the right development partner provides more than just code; they deliver the strategic insight required to navigate this high-stakes environment and build a financial product with lasting value.

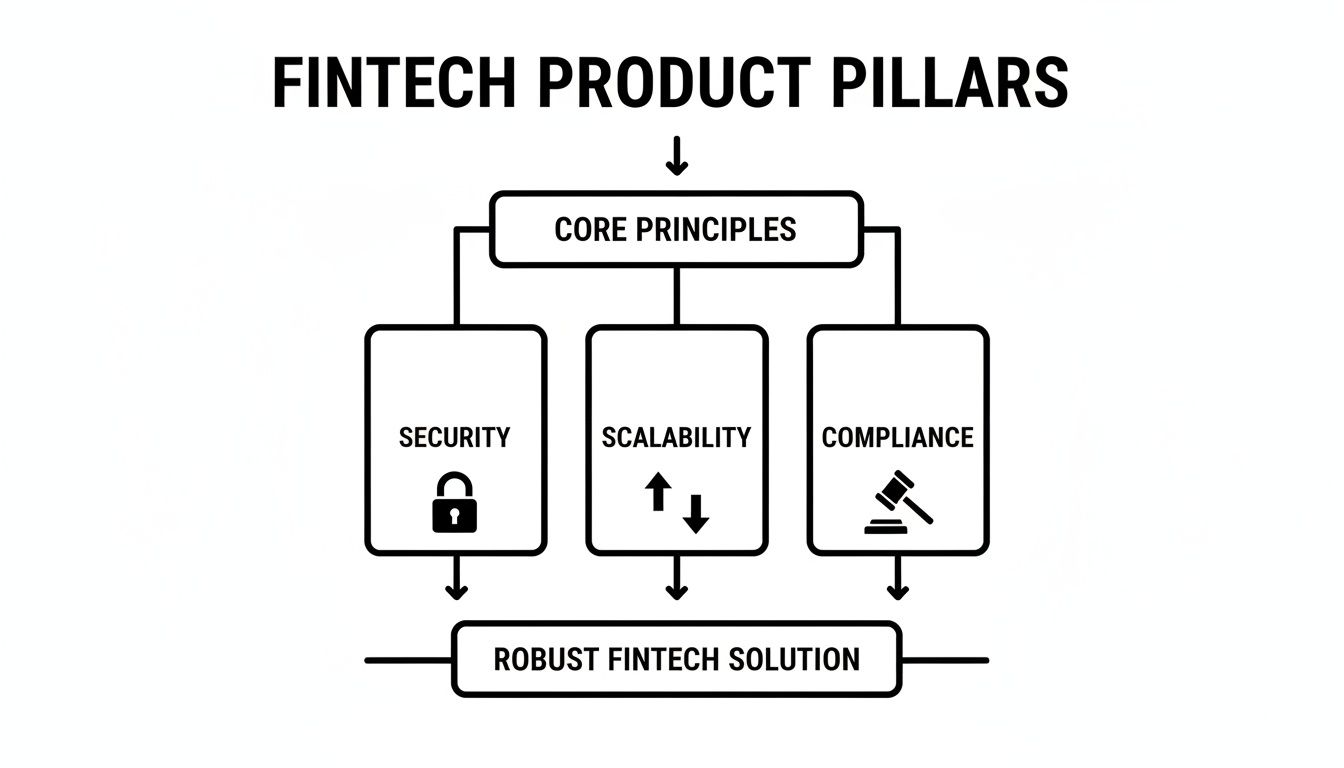

The Three Pillars of a Bulletproof Fintech Product

When you build a fintech product, you are fundamentally building a foundation of trust. Every successful platform stands on three non-negotiable pillars: ironclad security, effortless scalability, and unwavering compliance.

These are not features to be added later; they are the architectural DNA of your product. The choices made on day one dictate performance, costs, and reputation for years to come. Neglecting any one of these pillars can cause the entire structure to fail.

Pillar 1: Ironclad Security

In finance, security is paramount. You are asking users to entrust you with their most sensitive financial data, and any perceived weakness will drive them away. This extends far beyond a simple password policy.

The gold standard is a “zero-trust” security model, which operates on a simple premise: never trust, always verify. No user, device, or system is granted access without explicit authentication and authorization for every action, even if it’s already inside the network perimeter.

A truly secure system requires layered defenses:

- End-to-End Encryption: Data must be unreadable to unauthorized parties, both in transit and at rest in your database.

- Threat Modeling: Proactively identify and map potential vulnerabilities from an attacker’s perspective before they can be exploited.

- Regular Penetration Testing: Hire ethical hackers to rigorously test your systems and uncover vulnerabilities that automated scans might miss.

- Secure Coding Practices: Developers must be trained to write code that is inherently resistant to common attacks like SQL injection and cross-site scripting (XSS).

Pillar 2: Effortless Scalability

Imagine your app receives an unexpected feature in a major publication, causing sign-ups to explode by 1000% in one hour. Does your platform seamlessly handle the surge, or does it crash, creating a poor first impression for thousands of potential customers?

That is the essence of scalability. It’s about designing a system that can gracefully handle growth, whether you have one hundred users or one million. A modern cloud-native architecture is essential, allowing you to dynamically allocate resources as needed. This ensures you have the power to manage peak demand without paying for idle infrastructure during quiet periods, optimizing both performance and cost.

Pillar 3: Absolute Compliance

The financial industry is a maze of regulations. Compliance is not a one-time checklist; it is a continuous process that must be integrated into daily operations.

Key regulations to address include:

- KYC and AML: You are legally required to Know Your Customer and implement Anti-Money Laundering protocols to detect and report suspicious activity. Automated tools are essential for efficient compliance.

- Data Privacy Regulations: Laws like GDPR in Europe and CCPA in California impose strict rules on handling user data, with non-compliance leading to severe financial penalties.

- Payment Standards: Any organization handling credit card data must comply with the Payment Card Industry Data Security Standard (PCI DSS), a stringent set of security protocols with no room for error.

These three pillars are interconnected through intelligent integrations and well-designed APIs. A robust API strategy enables secure connections to third-party services for functions like payment processing or identity verification, creating a powerful, cohesive ecosystem. Understanding API development best practices is a crucial step in this process.

How to Choose the Right Technology Stack

Selecting the right technology for your fintech product is a critical business decision. The tech stack is the foundation that ensures security, handles transactions flawlessly, and provides the agility to outpace competitors. The wrong choice leads to higher long-term costs, a slower time-to-market, and a product that cannot scale.

This is not a purely technical decision. The ideal stack must align with your business goals, whether you are a startup building a Minimum Viable Product (MVP) or an established enterprise launching a new digital service. At Group107, we guide clients by focusing on technologies that deliver real-world business results.

Frontend and Backend Considerations

The backend is the engine of your application, where reliability and security are non-negotiable.

- Java (with Spring): A workhorse for large-scale enterprise systems, Java’s robustness, strong typing, and extensive libraries make it ideal for complex transaction processing where stability is a core requirement.

- Python (with Django or Flask): Known for rapid development, Python is an excellent choice for building MVPs. It also excels in data-intensive applications and AI-driven tools like fraud detection and credit scoring models.

The frontend is what your customers see and interact with, demanding a smooth, intuitive, and fast experience.

- React: A dominant force in frontend development, React’s component-based architecture is perfect for building complex, dynamic user interfaces like financial dashboards.

- Angular: Backed by Google, Angular is a comprehensive framework often preferred by enterprises for its structured approach, which promotes consistency across large development teams.

Cloud Platforms and Architectural Choices

Your choice of a cloud provider is another foundational decision. The major players offer services tailored for financial institutions, including advanced security, data analytics, and compliance tools.

- Amazon Web Services (AWS): As the market leader, AWS provides an extensive suite of services, from secure computing to machine learning, making it a versatile choice for fintechs of all sizes.

- Microsoft Azure: A natural fit for businesses within the Microsoft ecosystem, Azure offers strong hybrid cloud capabilities and robust compliance certifications.

Beyond the provider, the architecture is key. A microservices architecture is the standard for modern fintech. Instead of a single monolithic application, you build a collection of small, independent services. This allows you to update, scale, or fix one component without disrupting the entire system—a crucial advantage in a fast-moving market.

Database Selection and API Strategy

The database stores all critical financial data, making the SQL vs. NoSQL decision highly consequential.

- SQL (e.g., PostgreSQL): Built for transactional integrity (ACID compliance), SQL databases are the standard for systems requiring absolute consistency, such as payment ledgers.

- NoSQL (e.g., MongoDB): Better suited for large volumes of unstructured data like user profiles or activity logs, NoSQL databases offer flexibility and can accelerate development cycles.

As the diagram illustrates, every layer of your tech stack must serve the foundational principles of security, scalability, and compliance. Building a connected ecosystem is paramount, and our guide on API development best practices offers expert insights into creating secure and efficient integrations.

Technology Stack Comparison for Fintech Applications

To clarify how these technologies fit different use cases, here is a high-level comparison.

| Technology Layer | Option A (e.g., Python/Django) | Option B (e.g., Java/Spring) | Best Suited For |

|---|---|---|---|

| Backend | Fast development, ideal for data science and AI/ML integrations. | Extremely robust, high-performance, and secure for enterprise-grade systems. | Option A: MVPs, AI-driven fraud detection, robo-advisors. Option B: Core banking platforms, payment gateways. |

| Frontend | Typically paired with React or Vue.js for dynamic, modern UIs. | Often uses Angular for structured, large-scale enterprise applications. | Option A: PFM tools, investment dashboards. Option B: Complex institutional banking portals. |

| Database | Often uses PostgreSQL for data integrity and MongoDB for flexibility. | Heavily relies on SQL databases like PostgreSQL or Oracle for ACID compliance. | Option A: Hybrid use cases mixing transactional and user data. Option B: Systems requiring absolute transactional consistency. |

Ultimately, there is no single “best” stack—only the stack that best serves your product, team, and long-term vision. The right choice requires balancing speed, security, and scalability from the very beginning.

Finding Your Ideal Fintech Delivery Model

Deciding how to build your fintech product is as critical as deciding what to build. The right delivery model depends on your budget, timeline, and in-house capabilities. This decision directly impacts your speed-to-market, upfront investment, and ability to scale.

An incorrect choice can lead to wasted capital or a missed market opportunity. The key is to match your execution strategy to your current business stage.

Starting Smart with a Minimum Viable Product (MVP)

For most new fintech ventures, the journey begins with a Minimum Viable Product (MVP). An MVP is not merely a stripped-down product; it is a strategic tool for learning. It contains just enough core functionality to solve a real problem for a targeted group of early adopters.

The benefits of an MVP approach are significant:

- Market Validation: Test your core assumptions with real users and transactions, gathering invaluable feedback before committing to a larger investment.

- Reduced Risk: A focused initial build dramatically lowers upfront costs. A successful MVP validates the concept and strengthens your case for future funding.

- Faster Time-to-Market: Launching quickly allows you to establish a market foothold, begin collecting user data, and iterate based on actual behavior, not assumptions.

Scaling Up: End-to-End Development vs. Team Augmentation

Once your idea is validated or if you are an established company with a well-defined product, a more comprehensive approach is needed.

End-to-End Product Development: In this model, a partner like Group107 manages the entire project lifecycle—from strategy and design through engineering, testing, launch, and ongoing support. It is ideal for companies that need a complete, polished solution without building an in-house team from scratch.

Alternatively, Team Augmentation offers a flexible model to fill specific skill gaps. If your team lacks expertise in blockchain or AI, or if you need additional developers to meet a critical deadline, this model allows you to integrate expert offshore developers directly into your existing workflow. It is a cost-effective way to scale your team’s capacity without long-term overhead. Our guide explains how the dedicated development team model helps businesses scale effectively.

For additional context on collaboration models, this overview of outsourcing software projects is a valuable resource. At Group107, we leverage flexible models that provide access to top global talent, ensuring a clear path to market with a strong ROI.

The Advanced Technologies Creating Market Leaders

While standard development can produce a functional product, today’s market leaders are built differently. They integrate a strategic blend of advanced technologies that create a sustainable competitive advantage. The real differentiator is weaving intelligence, automation, and inclusivity into the core user experience.

These technologies are not add-ons; they are fundamental components that shape user trust, operational efficiency, and market reach. By mastering Artificial Intelligence (AI), DevOps, and digital accessibility, a fintech product can evolve from a simple utility into an indispensable financial tool.

AI and Machine Learning: The Intelligence Layer

Artificial Intelligence and Machine Learning (ML) act as the brains of a modern fintech operation. They analyze vast datasets in real-time to identify patterns, predict outcomes, and automate decisions that were once slow and manual. This capability is transforming financial services.

A prime example is fraud detection. AI-driven systems analyze millions of transactions per second, detecting subtle anomalies that indicate criminal activity with far greater accuracy than human teams. This not only prevents financial losses but also builds profound user trust.

Other impactful applications include:

- Predictive Credit Scoring: ML models use alternative data to assess creditworthiness, opening access to lending for previously underserved populations while precisely managing risk.

- Personalized Financial Guidance: Robo-advisors leverage algorithms to create and manage investment portfolios tailored to individual goals and risk tolerance, democratizing wealth management.

- Automated Underwriting: AI can process insurance and loan applications in minutes instead of days, dramatically improving both the customer experience and operational efficiency.

DevOps and CI/CD: The Speed Layer

In the highly regulated financial sector, achieving speed without sacrificing stability is a major challenge. A mature DevOps culture, powered by a Continuous Integration and Continuous Deployment (CI/CD) pipeline, solves this. It automates the build, test, and release process, enabling rapid innovation while maintaining security and compliance.

A CI/CD pipeline acts as an automated quality control assembly line. Every code change is automatically tested for security vulnerabilities, compliance gaps, and bugs before it ever reaches a customer.

This level of automation is non-negotiable in modern fintech. It is how you deploy new features faster than competitors while maintaining the bulletproof reliability that regulators and users demand.

This approach is a cornerstone of our DevOps as a Service offering, where we engineer resilient pipelines designed to accelerate your time-to-market.

Digital Accessibility: The Inclusivity Layer

Digital accessibility, guided by standards like the Web Content Accessibility Guidelines (WCAG), is a critical yet often overlooked component of a winning strategy. It involves designing products that are usable by everyone, including people with disabilities. This is not just a compliance requirement—it is a powerful business advantage.

An accessible platform is inherently more user-friendly for all. Ensuring your application works with screen readers, keyboard navigation, and other assistive technologies creates a higher-quality experience for your entire user base.

More importantly, it expands your total addressable market. Over one billion people worldwide live with some form of disability. Ignoring accessibility means ignoring a massive segment of potential customers. At Group107, our accessibility services position this as a clear competitive advantage, enabling you to build inclusive products that serve the widest possible audience.

How to Select the Right Fintech Development Partner

Choosing a development partner is the single most important decision you will make. This choice dictates your product’s security, speed-to-market, and long-term viability. The right partner is not just a vendor; they are a strategic advisor who can translate your business vision into a secure, scalable, and compliant reality.

A thorough selection process requires a structured approach to evaluate technical skills, industry expertise, and operational processes. A partner’s proven track record in regulated environments is the absolute baseline for success.

Verifiable Industry Experience

Begin by scrutinizing the partner’s portfolio for relevant projects. A generalist software firm cannot replace a team that has already navigated the complexities of financial regulations and security protocols.

Look for concrete evidence:

- Similar Solutions: Have they successfully launched payment gateways, lending platforms, or digital banking apps that handle real transactions for real users?

- Compliance Track Record: Request proof of building systems compliant with PCI DSS, SOC 2, GDPR, and CCPA. A team fluent in these standards designs compliance in from the start, preventing costly future remediation.

- Client Testimonials: Speak with past fintech clients to verify their problem-solving skills, communication, and ability to deliver under pressure.

For highly specialized projects, consider partners with niche expertise, such as a specialized Bitcoin consultancy, to ensure every detail is addressed correctly.

Technical Expertise and Security Protocols

Deep technical competence is the foundation of your fintech product. Your partner must demonstrate a profound understanding of the technologies that ensure security and scalability.

A partner’s commitment to security should be obsessive. In fintech, security is the bedrock of user trust. They should operate on a “zero-trust” model and bake security into every stage of development.

Key questions to ask include:

- Security Practices: How do they handle data encryption in transit and at rest? What are their processes for regular penetration testing and vulnerability scanning?

- Architectural Philosophy: Do they favor a microservices architecture for resilience and scalability? How do they leverage cloud-native tools on platforms like AWS or Azure for high availability?

- DevSecOps Maturity: Is security integrated into their CI/CD pipeline? Automated security checks should be a standard part of their workflow, not an afterthought.

Transparent and Collaborative Process

The best partners operate with complete transparency. You need a team that communicates clearly, sets realistic expectations, and functions as an extension of your own organization. Understanding what defines a great fintech development company is key to making the right choice.

Evaluate their operational model:

- Communication Rhythm: What tools (e.g., Slack, Jira) and routines (e.g., daily stand-ups) do they use to provide updates and gather feedback?

- Team Structure: Will you have a dedicated project manager and direct access to the development team? A dedicated team ensures focus and accountability.

- Post-Launch Support: What does their support and maintenance plan include? A true partner stands by their work, providing ongoing updates, security patches, and performance tuning.

Summary and Next Steps

Building a successful fintech product requires more than just code; it demands a strategic fusion of deep financial expertise, robust security, and scalable technology. The choices you make regarding your technology stack, delivery model, and development partner will directly impact your ability to compete and win in this dynamic market.

Key Takeaways:

- Prioritize Specialization: Partner with a team that has proven experience in the fintech domain to navigate complex security and compliance challenges effectively.

- Build on Three Pillars: Anchor your product development in ironclad security, effortless scalability, and unwavering compliance from day one.

- Choose the Right Tools: Select a technology stack and architecture (like microservices) that align with your long-term business goals, not just short-term trends.

- Leverage Advanced Tech: Integrate AI, DevOps, and accessibility to create a smarter, faster, and more inclusive product that stands out from the competition.

Ready to build a secure, scalable financial solution? Group107 provides expert fintech development services, from initial strategy to launch and ongoing support. Let’s discuss your project.