When you hear about fintech development services, don’t just think about lines of code. Think of them as the specialized teams that turn a brilliant financial idea—like a new payment app or a smarter lending platform—into a secure, compliant, and market-ready reality.

For any business, this is a game-changer. It means you can bypass the painfully steep learning curve of financial regulations and technology stacks, allowing you to focus on innovation and capturing market share. A strategic development partner provides the expertise to build a robust product that drives real business outcomes.

What Are Fintech Development Services and Why Do They Matter?

Fintech development services are a strategic partnership designed to bridge the gap between your financial concept and a tangible, working digital product. This is far more than just hiring developers; it’s about integrating an expert team that understands the complex intersection of finance, technology, and regulation.

Whether you’re a SaaS startup aiming to disrupt the market or a legacy financial institution looking to modernize, these services are the engine for growth. An expert partner does more than just execute a technical brief. They guide you through the maze of compliance, architect security protocols from the ground up, and build a system designed for scalability. This frees up your internal resources to concentrate on core business strategy and customer acquisition.

The Business Impact of Strategic Fintech Development

Choosing the right development partner is a critical business decision with a direct and measurable impact on your bottom line. By leveraging specialized expertise, you can dramatically accelerate your time-to-market. That disruptive idea can become a revenue-generating product far faster and more efficiently than if you tried to build an entire expert team from scratch.

In this market, speed is a decisive advantage. The global fintech sector is projected to hit USD 1.13 trillion by 2032, driven by a compound annual growth rate of approximately 16.2%. This explosive growth signifies a massive demand for new financial solutions, but also fierce competition.

A well-built fintech product isn’t just a tool for processing transactions. It’s a machine for building customer trust, streamlining operations, and carving out a lasting competitive advantage. It is the difference between having an app and owning a platform that drives sustainable growth.

Ultimately, the goal is to achieve a strong return on investment. This happens in several key ways:

- Accelerated Revenue Growth: Launch new products and features that solve real user problems, driving engagement, retention, and new customer acquisition.

- Enhanced Operational Efficiency: Automate manual processes like loan underwriting or customer onboarding to reduce overhead and free up your team for high-value tasks.

- Mitigated Risk: Embed security and compliance into the product from day one to avoid costly data breaches and regulatory fines. Expert partners can untangle complexities like a Fintech Offshore Setup for Simplified Banking and Compliance.

These services provide the foundation for building solutions that are not only technically sound but are architected for commercial success. For a detailed breakdown of selection criteria, explore our guide on choosing the right fintech software development services for your project.

The Three Pillars of a Bulletproof Fintech Architecture

Every successful fintech product is built on three non-negotiable pillars: ironclad security, unwavering compliance, and intelligent scalability. These are not buzzwords; they are the foundational elements that determine whether your platform will earn user trust, operate legally, and grow with your customer base.

Getting these pillars right from day one is essential for long-term success. Neglecting them is like building on quicksand.

Think of it like constructing a skyscraper. Without a solid foundation (compliance), strong structural steel (security), and a design that can accommodate more floors (scalability), the entire structure is a disaster waiting to happen. Each pillar supports the others, creating a resilient system ready for future demands.

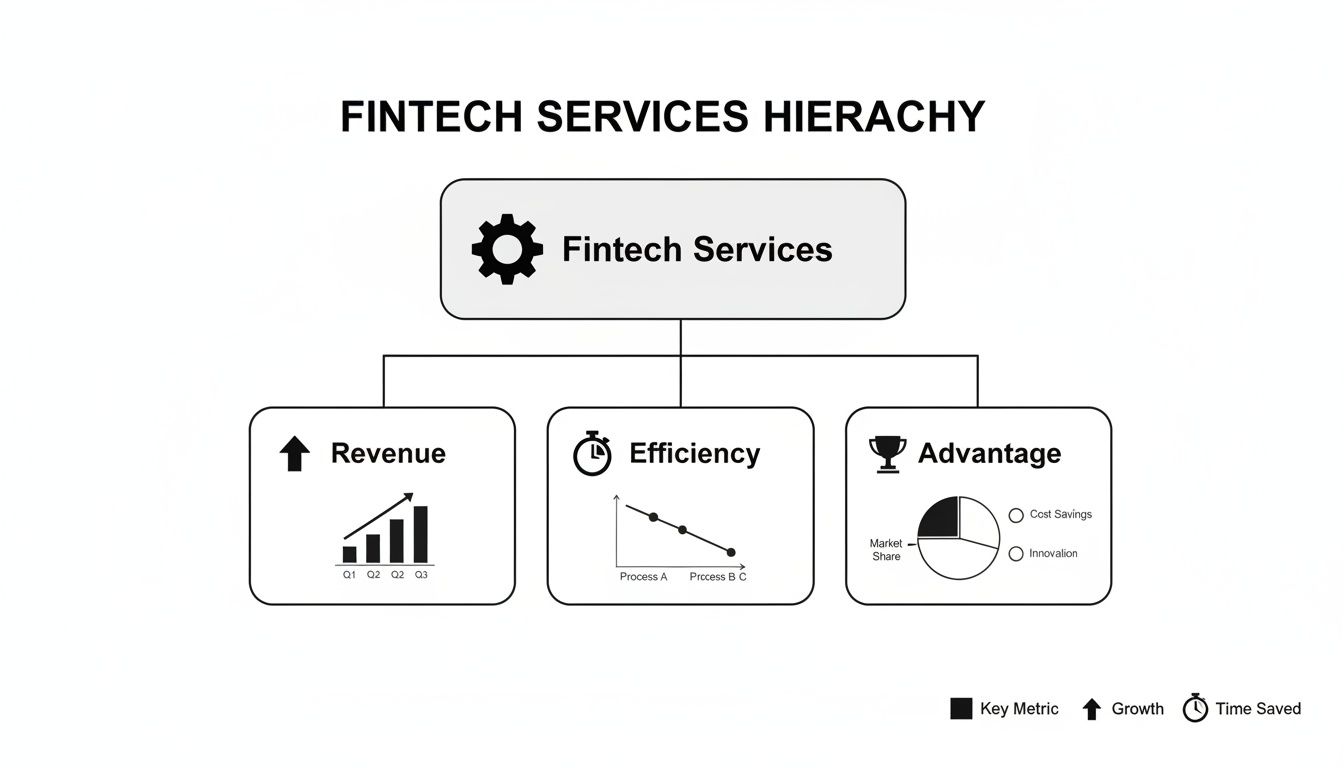

This diagram illustrates how core technical strength directly translates into key business outcomes: revenue growth, improved efficiency, and a sustainable competitive edge.

It’s a clear visual: technical excellence is not just an engineering goal; it delivers tangible business value.

Pillar 1: Security First and Foremost

In fintech, security isn’t a feature—it’s the bedrock of trust. A single breach can destroy a company’s reputation overnight and trigger severe financial and legal repercussions. A bulletproof security strategy is not about a single strong lock; it’s a multi-layered defense system designed to counter a wide range of threats.

When we talk about security in fintech development services, we are referring to a “defense-in-depth” strategy. The core principle is simple: assume no single security measure is infallible, so layer multiple controls to protect data and systems.

Here’s what that looks like in practice:

- Data Encryption: All sensitive data must be encrypted, both at rest (in a database) and in transit (across networks), using industry-standard algorithms. This ensures that even if data is compromised, it remains unreadable.

- Secure Access Controls: Implementing multi-factor authentication (MFA) and role-based access control (RBAC) is non-negotiable to ensure only authorized personnel can access specific data and functions.

- Proactive Fraud Detection: We leverage AI and machine learning to monitor transactions in real-time. These systems are trained to identify anomalous patterns and flag suspicious activity before it causes financial damage.

Pillar 2: Compliance by Design

Compliance is not a bureaucratic hurdle to be cleared at the end of a project; it’s your license to operate in the financial industry. Building a platform without integrating regulatory requirements from the start leads to costly redesigns, massive fines, and potential business shutdowns.

That’s why we practice “compliance by design.” This means every feature, process, and data flow is engineered with regulatory frameworks in mind. For example, if you are targeting the European market, GDPR principles must be integral to your data architecture, not an afterthought.

A proactive compliance strategy transforms a potential liability into a competitive advantage. It demonstrates to users, partners, and regulators that your platform is built on a foundation of trust and integrity.

Key compliance frameworks to build for include:

- KYC (Know Your Customer): Automating identity verification processes to prevent fraud and comply with regulations.

- AML (Anti-Money Laundering): Implementing systems to monitor transactions and report suspicious financial activities.

- PCI DSS (Payment Card Industry Data Security Standard): Adhering to strict standards for handling cardholder data to protect against fraud.

Pillar 3: Scalability for Future Growth

A platform that performs well with 1,000 users must perform just as flawlessly when 10 million users are active. Scalability is your system’s ability to handle increasing workloads without performance degradation. If your architecture cannot scale, you have placed a hard ceiling on your own growth potential.

Imagine your platform as a highway. It must be designed to handle peak rush hour traffic as efficiently as it handles a few cars in the middle of the night. A well-designed system achieves this using modern architectural patterns like microservices. For a deep dive, check out our guide on microservices architecture best practices. This is a key strategy for building fintech solutions that can grow on demand.

By breaking a large application into smaller, independent services, you can scale only the components that need it, which is more efficient and prevents system-wide failures.

Choosing the Right Technology Stack for Your Product

Selecting your technology stack is like laying the foundation for a skyscraper. Get it right, and you can build something remarkable. Get it wrong, and you will contend with structural flaws and instability for years. This is one of the most critical decisions in fintech development, defining not just how your product is built, but also how it will perform, scale, and evolve.

A mismatched stack can lead to performance bottlenecks, create security vulnerabilities, or force a costly and disruptive rebuild down the road.

The needs of a high-frequency trading platform, where every microsecond matters, are vastly different from those of a mobile wallet that must be intuitive and responsive for everyday users. Your choice must be intentional and aligned with your specific business objectives.

Deconstructing the Fintech Stack

A fintech application is not a monolithic piece of code; it’s a series of interconnected layers. Understanding how they work together is the first step toward making an informed decision.

- Front-End (The User Interface): This is everything your customer sees and interacts with. In finance, the front-end must convey trustworthiness through a clean, responsive, and intuitive design. Frameworks like React and Angular are popular because they excel at building complex, data-heavy interfaces that remain fast and fluid.

- Back-End (The Core Logic): This is the engine room where critical operations occur—processing transactions, communicating with the database, and enforcing business rules. Python is a top choice for data-intensive tasks like fraud detection or risk analysis. For enterprise-grade systems requiring high performance and stability, Java remains a go-to option.

- Database (The Vault): Financial data must be stored with absolute integrity. PostgreSQL is a workhorse in this space due to its strict adherence to ACID principles (Atomicity, Consistency, Isolation, Durability), which are non-negotiable for any system handling financial transactions.

- Cloud Infrastructure (The Foundation): Modern fintech runs on the cloud. Platforms like Amazon Web Services (AWS) and Microsoft Azure provide the secure, scalable, and compliant environments necessary for safe operation. They manage essentials like data encryption, disaster recovery, and regulatory adherence so you can focus on building your product.

Matching Technology to Use Cases

There is no single “best” stack. The right stack is the one that perfectly fits your product’s requirements. For example, a peer-to-peer lending platform requires a back-end capable of complex interest calculations, while a simple payment app prioritizes fast, secure API calls.

For more advanced applications, technologies like blockchain technology are becoming essential for building transparent and tamper-proof systems, particularly in areas like cross-border payments.

The most strategic technology decisions look beyond today’s features to anticipate tomorrow’s demands. A stack chosen for scalability from day one prevents a crisis when your user base grows from one thousand to one million.

This foresight is what separates good development partners from great ones. It’s about selecting tools that not only meet today’s needs but also provide the flexibility to innovate in the future.

Comparing Popular Fintech Technology Stacks

The table below compares common technology choices for fintech applications, highlighting their strengths and ideal use cases to guide your development decisions.

| Technology Layer | Popular Options | Key Strengths for Fintech | Best Suited For |

|---|---|---|---|

| Front-End | React, Angular, Vue.js | React: Ideal for creating dynamic, single-page applications with high performance. Angular: Offers a comprehensive framework for building large-scale, enterprise-level applications. Vue.js: Known for its simplicity and ease of integration, making it great for MVPs. |

Digital wallets, investment dashboards, and customer-facing banking portals that require a responsive and interactive user experience. |

| Back-End | Python, Java, Node.js | Python: Excellent for AI/ML-driven features like fraud detection and credit scoring. Java: Provides stability and performance for complex, high-transaction systems. Node.js: Fast and efficient for real-time applications like trading platforms. |

Core banking systems, lending platforms, payment gateways, and any application requiring secure and scalable server-side logic. |

| Database | PostgreSQL, MySQL, MongoDB | PostgreSQL/MySQL: Offer strong data integrity and ACID compliance, essential for transactional data. MongoDB: Provides flexibility and scalability for handling large volumes of unstructured or semi-structured data. |

Storing sensitive user data, transaction records, and audit logs. NoSQL is often used for analytics or caching layers. |

| Cloud Platform | AWS, Azure, GCP | AWS: Offers the most extensive suite of services, including specialized financial services tools. Azure: Strong in hybrid cloud environments and enterprise integrations. GCP: Known for its strengths in data analytics and machine learning. |

Hosting the entire application infrastructure, ensuring high availability, disaster recovery, and compliance with standards like PCI DSS and SOC 2. |

The goal is to select a set of technologies that not only meets immediate product requirements but also aligns with your team’s expertise and long-term business vision.

Finding a Strategic Delivery Model That Fits Your Business

The what of your fintech product is crucial, but the how you build it is just as important. Choosing the right delivery model—the framework for engaging a development partner—can determine your project’s budget, timeline, and ultimate success. This strategic choice must align with your business goals, whether you’re a lean startup validating an idea or a global enterprise addressing a skills gap.

The wrong model leads to misaligned expectations, spiraling costs, and a product that fails to meet market needs. The right model delivers the precise blend of flexibility, expertise, and cost-efficiency required to build a competitive solution.

Building a Minimum Viable Product (MVP)

For startups or established companies exploring a new market, the MVP is the proven method for validating a concept without excessive investment. An MVP is not a half-finished product; it is a focused version that solves one core problem for a specific audience. The objective is to get a functional product into the hands of real users quickly to gather actionable feedback.

This strategic approach minimizes initial development costs and risk by concentrating only on essential features. The feedback from early adopters is invaluable, guiding future development and ensuring you build a product that customers will actually use and pay for.

Augmenting Your In-house Team

If you have a solid development team but need to fill a specific capability gap, team augmentation is an effective way to scale capacity or acquire niche skills without the overhead of full-time hiring. This model involves integrating specialized external talent—such as a DevOps engineer, a cybersecurity expert, or an AI specialist—directly into your existing team.

The benefits are clear:

- Access to Specialized Skills: Instantly gain top-tier expertise in complex areas like AI, blockchain, or specific compliance frameworks.

- Increased Flexibility: Scale your team up for a major project and then down again, maintaining agility and cost control.

- Knowledge Transfer: Your internal team learns directly from the experts, enhancing your in-house capabilities for the long term.

This model keeps you in control while injecting the precise talent needed to overcome technical challenges and meet deadlines.

End-to-End Product Development

When you have a complete product vision but lack the internal team to execute it, end-to-end development is the solution. In this model, a partner like Group 107 takes full ownership of the entire product lifecycle—from initial strategy and UI/UX design through to development, testing, deployment, and ongoing support.

This is a true partnership, not just outsourcing. We become your dedicated product team, handling project management, technical leadership, and daily execution. This allows you to focus on your core competencies: business strategy, marketing, and customer acquisition, while we manage the complexities of building a secure, scalable, and compliant fintech platform.

Choosing a delivery model is also an investment decision. Global fintech investment has been volatile, with recent trends showing investors are becoming more selective, focusing on AI-enabled platforms and scaled winners. This underscores the importance of a model that demonstrates a clear, efficient path to profitability. Discover more insights about fintech investment trends on merchantsavvy.co.uk.

The Advantage of Nearshore and Offshore Development

Regardless of the model you choose, tapping into nearshore or offshore talent can provide a significant competitive advantage. By partnering with teams in technology hubs like Ukraine, companies can access a world-class engineering pool at a fraction of the cost, often achieving savings of up to 60% on labor.

At Group 107, we specialize in building these dedicated offshore teams that integrate seamlessly with your own. You get top-tier talent and uncompromising quality, security, and communication, allowing you to move faster, build smarter, and maximize your return on investment.

How to Select Your Ideal Fintech Development Partner

Choosing a partner for your fintech development services is one of the most critical decisions you will make. This choice impacts everything—your product’s quality, its security, and its probability of a successful launch. You are not just hiring a vendor to write code; you are selecting a strategic partner who understands the immense responsibility of handling financial data and operations.

The wrong choice can lead to security vulnerabilities, compliance nightmares, and a product that cannot scale. The right partner, however, becomes an extension of your team, offering proactive guidance, navigating complex regulations, and building a solution engineered for long-term success.

Look Beyond Technical Skills

Every development firm will claim technical proficiency. In fintech, that is merely the price of admission. The real differentiators are the qualifications that separate seasoned experts from generalist coders. Your evaluation must go much deeper.

A great partner doesn’t just build what you ask for—they challenge your assumptions and bring insights from dozens of other fintech projects. They are your first line of defense against costly mistakes and your strategic guide to building a resilient, market-leading product.

To find such a partner, you must ask the right questions and demand concrete proof. A flashy website or a low price can easily mask a critical lack of genuine fintech experience.

An Actionable Checklist for Vetting Partners

Use this checklist to conduct a rigorous and structured evaluation. A potential partner’s answers will quickly reveal their true depth of expertise and cultural fit.

- Demonstrable Industry Experience: Ask to see their portfolio of live, successful fintech products. Can they demonstrate a payment gateway, digital wallet, or lending platform they built from the ground up? Generic app development experience is insufficient.

- Regulatory Fluency: How do they handle compliance with standards like PCI DSS, GDPR, and KYC/AML? A top-tier partner will discuss their “compliance by design” philosophy, where regulations are integrated into the architecture from day one, not bolted on later.

- Security and DevOps Maturity: Request a detailed walkthrough of their security protocols and DevSecOps practices. How do they handle threat modeling, automated code scanning, and penetration testing? Their ability to clearly articulate a multi-layered security strategy is a key indicator of competence.

- Transparent Communication and Process: What does their development process look like? Insist on seeing their communication plan, project management tools, and reporting cadence. A transparent, agile methodology with clear feedback loops is non-negotiable.

While fintech adoption is high, the market is ruthless. Fintechs still capture only about 3% of global financial services revenue, with most of that generated by a few established firms. This underscores the critical importance of a partner who can help build a product that can compete and win market share.

An integrated partner like Group 107 brings more than just development expertise. Our proficiency in DevOps, AI, and accessibility ensures your product is not just functional—it’s secure, scalable, and inclusive from the start. For a deeper dive on what to look for, read our guide on choosing a fintech development company.

Frequently Asked Questions About Fintech Development

Navigating fintech development brings up critical questions about cost, timelines, and potential challenges. Getting clear answers is essential for aligning your technology investment with your business goals. Let’s break down the most common questions we hear.

How Much Does Fintech App Development Cost?

There’s no simple price tag. The cost of fintech development services depends directly on your product’s complexity, required features, and chosen delivery model. However, we can provide a realistic range for budgeting.

A focused Minimum Viable Product (MVP)—designed to test a core concept with essential features—typically costs between $50,000 and $150,000. This approach is ideal for startups needing to validate their idea and gather user feedback quickly before committing to a larger investment.

A full-scale, enterprise-grade platform is a more significant undertaking. If you are building a solution with advanced features like AI-powered analytics, biometric security, multiple third-party integrations, and cross-border compliance, the budget will range from $250,000 to over $1,000,000.

Key cost drivers include:

- Platform Scope: Supporting iOS, Android, and Web simultaneously increases development time and cost.

- Regulatory Rigor: Stricter compliance requirements (like PCI DSS or SOC 2) demand more specialized and intensive engineering work.

- Ongoing Support: Your budget must account for post-launch maintenance, security updates, and future feature development.

Partnering with an experienced offshore or nearshore team can significantly impact costs. It’s common to see development savings of up to 60% while accessing a global pool of specialized talent.

What Are the Biggest Challenges in Fintech Development?

Every fintech project faces three core challenges: security, compliance, and scalability. Addressing these effectively is the difference between a resilient platform and a failed one.

- Security: Fintech platforms are prime targets for cyberattacks. Security cannot be an afterthought; it must be integrated from day one. This requires a defense-in-depth approach, including end-to-end data encryption, multi-factor authentication (MFA), and proactive, AI-powered fraud monitoring.

- Regulatory Compliance: The financial industry is governed by a complex and evolving web of regulations like PCI DSS, GDPR, and AML. Non-compliance leads to severe fines, revoked licenses, and irreparable brand damage.

- Scalability: Your platform must be architected for growth from the outset. An application that runs smoothly for 1,000 users must perform equally well for one million. Failure to build for scale will result in performance degradation, system crashes, and user frustration just as your business gains traction.

It is non-negotiable to select a development partner with deep, proven experience in all three of these areas.

How Long Does the Fintech Development Process Take?

The timeline is dictated by the project’s size and complexity. A well-planned MVP with a focused feature set can often be designed, built, and launched in 4 to 6 months. This accelerated timeline is ideal for rapid market entry and concept validation.

A full-featured, enterprise-level platform is a much larger endeavor, typically taking 9 to 18 months or longer from initial concept to full deployment. These projects are almost always managed using an agile methodology, which breaks the work into smaller, manageable sprints.

A typical project timeline might look like this:

- Discovery and Strategy: 4–6 weeks

- UI/UX Design: 4–8 weeks

- Core Development Sprints: 16–30+ weeks

- Rigorous Testing and Deployment: 4–8 weeks

A clear project roadmap and transparent communication are essential for keeping a complex build on time and on budget.

Expert Insight: The single most effective way to accelerate development is to establish a crystal-clear product strategy from the start. Time invested in the discovery phase—defining user flows, technical requirements, and a compliance plan—will save a fortune in costly rework later.

Why Is API Integration so Important in Fintech?

APIs (Application Programming Interfaces) are the connective tissue of the modern financial ecosystem. They are secure gateways that allow different software systems to communicate, share data, and interoperate seamlessly.

Without APIs, every fintech product would be an isolated island, unable to perform many of its most valuable functions.

For example, APIs enable you to:

- Connect a budgeting app to a user’s bank accounts to retrieve transaction history.

- Process payments securely through a gateway like Stripe or Adyen.

- Verify a new user’s identity against a third-party database to meet KYC requirements.

- Pull real-time stock prices into an investment platform.

A well-designed API strategy is fundamental. It allows you to leverage best-in-class services instead of building everything from scratch, connect with strategic partners, and deliver a rich, seamless experience to your users.

Summary and Next Steps

Building a successful fintech product requires more than just technical skill; it demands a strategic partnership with a team that deeply understands security, compliance, and scalability. The right fintech development services accelerate your time-to-market, mitigate risk, and position your product for long-term growth and profitability.

To move forward, take these actionable next steps:

- Define Your Core Problem: Clearly articulate the specific user pain point your fintech product will solve. This will be the foundation of your MVP.

- Assess Your Internal Capabilities: Honestly evaluate your in-house skills. Do you need end-to-end development, or can team augmentation fill your gaps?

- Vet Potential Partners Rigorously: Use the checklist provided to evaluate potential partners on their proven fintech experience, regulatory fluency, and security practices—not just their technical claims.

Ready to turn your fintech vision into a secure, scalable, and compliant reality? The expert offshore teams at Group 107 deliver end-to-end development services that accelerate your time-to-market while maximizing your ROI. Contact us today to build your dedicated team.