Fintech software development is the engine that powers modern finance. It encompasses everything from mobile banking apps and seamless payment gateways to the complex AI algorithms that detect fraud. Executing this development flawlessly isn’t just a technical task—it’s a core business strategy for innovation, customer retention, and market leadership.

Why Fintech Software is a Strategic Imperative

Viewing fintech development as just another IT project is a critical mistake in today’s digital-first economy. It’s the driving force behind the financial industry’s evolution, empowering businesses to solve persistent challenges and unlock new revenue streams. For SaaS, e-commerce, and enterprise-level companies, a custom fintech solution is no longer a luxury; it’s foundational to sustainable growth.

Market data validates this shift. The global fintech software market is projected to skyrocket from $255.1 billion in 2025 to over $1 trillion by 2034, reflecting a compound annual growth rate of 16.5%. This explosive growth is driven by the relentless demand for superior digital banking, mobile-first experiences, and intelligent analytics.

From Inefficiency to Innovation

Many businesses are still constrained by legacy systems that create operational bottlenecks, from cumbersome payment processing to manual, error-prone compliance checks. Expert fintech software development services dismantle these outdated structures, replacing them with agile, secure, and scalable solutions built for the future.

This transformation delivers tangible business outcomes:

- Enhanced Customer Experience: Intuitive applications and frictionless payment flows build loyalty and reduce customer churn.

- Operational Efficiency: Automating repetitive tasks frees up your team to focus on high-value activities, reducing human error and cutting operational costs.

- Data-Driven Decision-Making: Custom analytics tools transform raw financial data into actionable insights for risk management and strategic planning.

- Scalable Growth: A modern, robust architecture ensures your platform can handle increasing transaction volumes and user growth without performance degradation.

When development is treated as a strategic investment rather than a cost, you move beyond patching problems. You build a technological foundation that supports long-term goals and establishes market leadership.

Ultimately, partnering with the right development experts transforms complex financial workflows into simple, elegant digital experiences. At Group107, we specialize in building these secure, user-centric platforms. Explore our approach through our dedicated fintech development services. This strategic focus ensures your technology not only solves today’s challenges but is also primed for future market demands.

Understanding Core Fintech Development Services

Effective fintech development is not about writing code; it’s about building a strategic asset that solves a specific business problem. A proficient development partner moves beyond technical jargon to focus on delivering measurable results, whether you’re launching a disruptive startup or modernizing a large-scale financial system. The objective remains consistent: create a secure, scalable, and user-friendly solution that drives growth.

This outcome-focused mindset shapes several core services, each designed for a specific stage of a company’s lifecycle. These are the essential building blocks for any modern financial platform.

Building and Testing Your Vision

For a startup, speed to market is paramount. Minimum Viable Product (MVP) development is the fastest way to validate your business idea. An MVP is a streamlined version of your product containing only the essential features needed to attract early adopters. This approach allows you to test market assumptions and gather real-world user feedback without the cost of a full-scale build.

Once the concept is proven, the focus shifts to custom platform development. This is where we build the robust digital infrastructure for services like:

- Digital Banking Applications: Providing customers with secure, 24/7 access to accounts, transfers, and other banking functionalities.

- Investment and Wealth Management Platforms: Creating intuitive tools for portfolio tracking, trading, and financial planning.

- Payment Gateways: Engineering the secure infrastructure that enables transactions for e-commerce platforms and SaaS businesses.

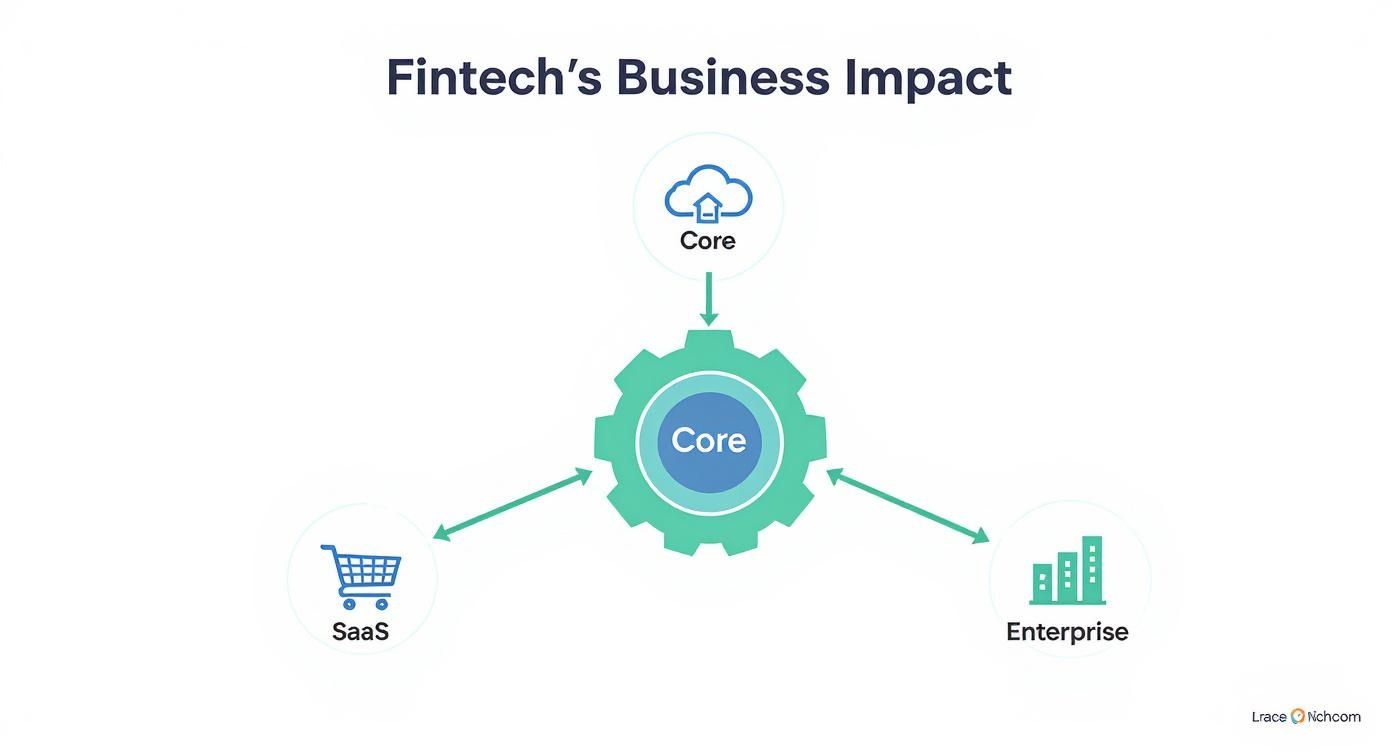

This diagram illustrates how these core services connect to drive business value across different sectors.

The central technology core acts as the engine for innovation, powering everything from enterprise solutions to cloud-based services.

Integrating and Modernizing Systems

No fintech platform operates in isolation. API development and integration serves as the connective tissue, linking your platform to external systems like payment processors, credit bureaus, and banking networks. A well-designed API ensures secure and seamless data flow, creating a cohesive user experience. To understand how these components interoperate in modern finance, exploring the fundamentals of blockchain development is an excellent starting point.

Finally, many established financial institutions are encumbered by outdated technology. Legacy system modernization involves migrating these cumbersome and insecure platforms to modern, cloud-native architectures. This process not only enhances performance and security but also dramatically reduces maintenance costs and unlocks the agility needed for future innovation.

Navigating Fintech Security and Regulatory Compliance

In finance, trust is the ultimate currency. For any fintech platform, that trust is built upon two pillars: ironclad security and rigorous regulatory compliance.

This is not merely about avoiding fines or satisfying auditors; it’s about protecting your customers, your reputation, and your entire business. A single data breach or compliance failure can irrevocably damage user confidence and halt growth.

Therefore, treating security as an afterthought is a critical error. A strategic fintech software development services partner integrates compliance into the product from the first line of code. This “security-by-design” approach transforms a potential regulatory burden into a significant competitive advantage, signaling to the market that your platform is built on a foundation of trust.

Core Regulations You Cannot Ignore

The regulatory landscape is complex, but several key standards form the bedrock of fintech compliance. Mastering these is the first step toward building a resilient platform.

- Payment Card Industry Data Security Standard (PCI DSS): If your platform processes, stores, or transmits credit card information, PCI DSS compliance is mandatory. It provides the framework for creating a secure environment to prevent cardholder data theft.

- General Data Protection Regulation (GDPR): This regulation sets the global standard for data privacy. It governs how you handle the personal data of EU citizens, emphasizing transparency, user consent, and data rights.

- Know Your Customer (KYC) & Anti-Money Laundering (AML): These protocols are your primary defense against financial crime. KYC procedures focus on verifying customer identity, while AML regulations involve monitoring transactions to detect and report suspicious activities.

A truly secure fintech product doesn’t just meet the letter of the law; it embodies its spirit. This requires building a culture where protecting customer data is a core operational priority, not just a compliance checkbox.

Building Compliance into Your Software

Your development partner must demonstrate exactly how they embed these regulations into your software’s architecture. This involves implementing robust technical safeguards that operate continuously.

Key measures include end-to-end data encryption, secure authentication protocols like multi-factor authentication (MFA), and continuous vulnerability scanning to identify and remediate weaknesses. To gain a deeper understanding of available solutions, explore the best data security technologies to avert cyber threats in our comprehensive guide.

For further insights into protecting financial transactions, resources on automated chargeback and dispute management using AI are invaluable. When vetting potential partners, demand proof of their security-first development process to ensure your product is built to withstand regulatory scrutiny and protect users from day one.

The Technology Stack Powering Modern Fintech

Selecting the right technology stack for your fintech platform is like choosing the engine for a high-performance vehicle—it determines your speed, reliability, and ability to compete. The tech stack is a strategic decision that directly impacts performance, scalability, and data security.

An expert fintech software development services provider knows how to blend battle-tested technologies with innovative tools. Each component is selected to perform a specific function, from detecting fraud in milliseconds to delivering personalized financial advice at scale.

AI and Machine Learning for Smarter Finance

Artificial Intelligence (AI) and Machine Learning (ML) are the cognitive core of modern fintech. These technologies excel at identifying subtle patterns within massive datasets, providing a significant competitive advantage.

- Fraud Detection: AI algorithms can analyze thousands of transactions per second, flagging suspicious activity with an accuracy far exceeding human capabilities.

- Personalized Recommendations: For SaaS and e-commerce, ML models analyze user behavior to offer tailored financial products, such as custom loan options or investment suggestions.

- Algorithmic Trading: In wealth management, AI systems execute trades based on complex market signals, working continuously to optimize portfolio performance.

The true value of AI in fintech is its ability to enable predictive, data-driven decisions at scale. This allows platforms to move from reactive problem-solving to proactively anticipating customer needs and identifying potential risks.

Core Infrastructure Technologies

While AI captures headlines, the underlying infrastructure provides the essential foundation. These technologies are the non-negotiable bedrock of any serious fintech application. A robust technology stack is built from key components, each playing a critical role.

Comparing Key Fintech Technologies and Their Applications

| Technology | Primary Use Case | Key Business Benefit |

|---|---|---|

| Cloud Computing (AWS, Azure, GCP) | Scalable infrastructure, hosting, and data storage. | Pay-as-you-go cost efficiency and the ability to handle traffic spikes without crashing. |

| Big Data Analytics (Hadoop, Spark) | Processing and analyzing massive datasets. | Uncovering customer insights, identifying market trends, and improving risk assessment. |

| AI & Machine Learning | Fraud detection, algorithmic trading, and personalization. | Automating complex decisions, reducing human error, and creating a tailored user experience. |

| Blockchain & DeFi | Secure, transparent, and decentralized transactions. | Enhancing security for cross-border payments, creating smart contracts, and enabling new financial models. |

These technologies are not mutually exclusive. The most powerful fintech platforms integrate them to create a synergistic solution.

- Cloud Computing (AWS, Azure, GCP): Cloud platforms like Amazon Web Services (AWS) and Microsoft Azure provide the flexibility and scalability fintech apps need. This pay-as-you-go model is cost-effective for startups and a strategic advantage for enterprises.

- Big Data Analytics: Fintech platforms generate vast amounts of data. Tools like Hadoop and Spark enable you to process this data and extract valuable business intelligence. The significant investor confidence in the sector, marked by a global fintech investment of $95.6 billion in 2025, is largely driven by this analytical capability. Explore more in various fintech trends and statistics reports.

- Blockchain and DeFi: For applications requiring absolute security and transparency, Blockchain offers an immutable, decentralized ledger ideal for cross-border payments and smart contracts. It is also the technology underpinning Decentralized Finance (DeFi), which is building a new financial ecosystem outside of traditional banking.

How to Choose the Right Development Partnership Model

Selecting the right partner for your fintech software development services is a strategic decision that will impact your timeline, budget, and overall project success. The choice is not just about hiring developers; it’s about defining the entire collaborative relationship—from control and responsibility to daily workflow.

Getting this alignment wrong leads to friction and wasted resources. Getting it right creates a seamless, powerful partnership. There is no one-size-fits-all model; the optimal choice depends on your specific business context.

Staff Augmentation: Bridging Skill Gaps

Staff augmentation is ideal for adding specialized expertise to your existing team. If your in-house team excels at backend development but lacks a mobile UX expert or blockchain specialist, this model allows you to fill that specific skill gap on demand.

You retain full control over project management and daily tasks while integrating external experts into your team.

This approach is best for:

- Targeted Expertise: When you need a specific, hard-to-find skill.

- Short-Term Needs: Perfect for projects with a defined scope and timeline.

- Maintaining Control: You manage the augmented staff directly, ensuring alignment with your processes.

Dedicated Offshore Teams: For Long-Term Value

A dedicated offshore team is a long-term strategic partnership. You are essentially building a remote extension of your engineering department—a team that works exclusively on your projects. This model delivers consistency, deep product knowledge, and significant cost advantages.

This model is a powerhouse when you need:

- Full-Scope Development: Ideal for large-scale, ongoing platforms requiring a complete team.

- Cost Efficiency: Access to global talent pools can lead to substantial cost savings without sacrificing quality.

- Scalability: Allows you to scale your development capacity up or down quickly in response to business needs.

Choosing a dedicated team means investing in a partner who will gain a deep understanding of your business, goals, and culture. This shared context is a powerful driver of efficiency and innovation.

End-to-End Project Delivery: For Turnkey Solutions

With end-to-end delivery, you delegate full project ownership to your partner. You define the objectives, and they manage the entire lifecycle—from initial strategy and design through development, testing, and deployment.

This model is perfect when you lack the internal bandwidth or project management resources to oversee day-to-day development. It is a turnkey solution that delivers a finished product on a predictable timeline and budget, freeing you to focus on your core business.

Your Checklist for Selecting a Fintech Development Partner

Choosing the right partner for fintech software development services is a critical decision. Move beyond sales pitches and use a structured evaluation process to identify a team that can deliver a secure, scalable, and successful product. This checklist provides a framework for asking the right questions.

Technical Expertise and Industry Fit

General development skills are not enough; fintech requires deep domain knowledge.

- Do their case studies align with your project? Look for a proven track record in your specific fintech niche, whether it’s payments, wealth management, or financial SaaS.

- How deep is their fintech tech stack expertise? They should confidently discuss AI for fraud detection, secure API integrations, and cloud platforms like AWS or Azure.

- Can they prove their architecture scales? Your partner must demonstrate how their architectural design will handle significant growth in users and transactions.

Security and Compliance Protocols

In fintech, security is the foundation of customer trust. Your partner must have a security-first mindset.

Any potential partner should be able to articulate their security strategy from the first conversation. If they treat compliance as an afterthought, they are not the right fit for a high-stakes fintech project.

- Can they demonstrate experience with PCI DSS, GDPR, and KYC/AML? Ask for specific examples of how they have implemented these frameworks in past projects.

- What does their secure development lifecycle (SDLC) entail? Look for standard practices like rigorous code reviews, vulnerability scanning, and penetration testing.

- How do they handle data encryption? They should clearly detail their protocols for protecting data both in transit and at rest.

Development Process and Long-Term Support

The partnership extends beyond launch. A transparent process and a clear support plan are essential.

- How transparent is their development process? Look for signs of an agile methodology, including regular check-ins and direct communication with the development team.

- What engagement models do they offer? A flexible partner will provide options, from staff augmentation to a dedicated team. Learn more about the benefits of offshore software development to see how different models impact costs and control.

- What is the plan for post-launch support? A clear Service Level Agreement (SLA) is non-negotiable. It should define responsibilities for ongoing updates, bug fixes, and security patches.

Frequently Asked Questions About Fintech Development

Entering the world of fintech development raises critical questions about cost, timelines, and security. Here are straightforward answers to the most common inquiries we receive.

How Much Will a Fintech App Cost to Build?

There is no standard price for a fintech application. The final cost depends on the complexity of your features, the technology stack, and the number of third-party integrations required.

A streamlined Minimum Viable Product (MVP) with core payment or tracking features typically ranges from $50,000 to $100,000. A full-featured platform with AI-powered analytics, multi-currency support, and extensive compliance requirements could exceed $300,000. The most accurate estimate comes from a detailed project scope defined in a discovery phase.

What’s a Realistic Timeline for an MVP?

Speed to market is crucial. For a well-defined fintech MVP, a realistic timeframe is four to six months.

This window typically covers the entire initial process:

- Discovery and Strategy: Defining core features and the technical blueprint.

- UI/UX Design: Creating an intuitive and trustworthy user interface.

- Core Development: Building the essential frontend and backend functionality.

- Testing and Deployment: Ensuring the application is stable, secure, and ready for launch.

How Do You Keep Financial Data Safe During Development?

Security is integrated into our process from day one. We adhere to a secure software development lifecycle (SDLC), making data protection a priority at every stage.

A security-first mindset means all code is written with compliance in mind. This includes end-to-end data encryption, strict developer access controls, and continuous vulnerability scanning to proactively address weaknesses.

What’s the First Step to Get a Project Started?

Every successful fintech project begins with a comprehensive discovery phase. This is a collaborative process where we align on your vision, business goals, and technical requirements. Together, we define the problem you’re solving, identify your target customer, and prioritize the essential features for your MVP. This initial clarity ensures we are aligned and moving in the right direction from the start.

At Group107, we transform complex financial concepts into secure, scalable, and user-centric digital products. Our dedicated offshore teams build high-performance fintech platforms engineered for growth and compliance. Ready to build your vision? Connect with us today.