Determining the true fintech app development cost isn't a simple calculation—it's a strategic decision. A focused Minimum Viable Product (MVP) to validate a core concept might start at $50,000, while a scalable, enterprise-grade platform can exceed $500,000. This wide range exists because building a fintech application is a complex investment in security, user trust, and regulatory compliance. The final cost is directly tied to the complexity of your vision and the expertise of the team you hire to execute it.

Why Your Budget Is an Investment, Not an Expense

The first critical shift in mindset is to view your development budget as a strategic investment. Every dollar spent should directly contribute to achieving a specific business outcome—validating your market fit, acquiring your first user base, or engineering a platform capable of processing millions of secure transactions. The cost isn't merely for writing code; it's for earning user trust, navigating a complex web of financial regulations, and designing an experience that solves a tangible problem for your customers.

This guide provides a clear, actionable breakdown of the real costs involved, from essential features to the impact of your development team's location. Understanding these factors upfront empowers you to make informed decisions, balancing your ambitious vision with a practical, disciplined financial strategy that drives real business results.

A Practical Starting Point

To ground this discussion, let's establish typical costs and timelines based on application complexity. Partnering with a specialist provider of fintech software development services is the most effective way to ensure your project aligns with industry benchmarks from the outset.

Business Impact: A well-architected user experience can boost conversion rates by up to 400%. For every $1 invested in strategic design and development, businesses can see a return of up to $100. This is why treating your budget as a strategic investment is non-negotiable for success.

This overview provides a clear picture of what you can expect at different project tiers.

Fintech App Development Cost at a Glance

Use this table to frame initial budget discussions and set realistic expectations for what is achievable at each level of investment.

| App Complexity | Estimated Cost Range (USD) | Typical Timeline | Best For |

|---|---|---|---|

| MVP (Basic) | $50,000 – $70,000+ | 2-4 Months | Startups validating a core concept or seeking initial funding. |

| Mid-Tier App | $100,000 – $150,000+ | 4-8 Months | Companies scaling beyond a prototype with core banking, lending, or payment features. |

| Enterprise Platform | $200,000 – $500,000+ | 9+ Months | Established financial institutions requiring advanced AI, multi-currency support, and extensive compliance modules. |

These figures are a launchpad. Next, we will deconstruct what drives these estimates and how you can manage your budget effectively without compromising on quality or security.

The Core Drivers Behind Your Project's Budget

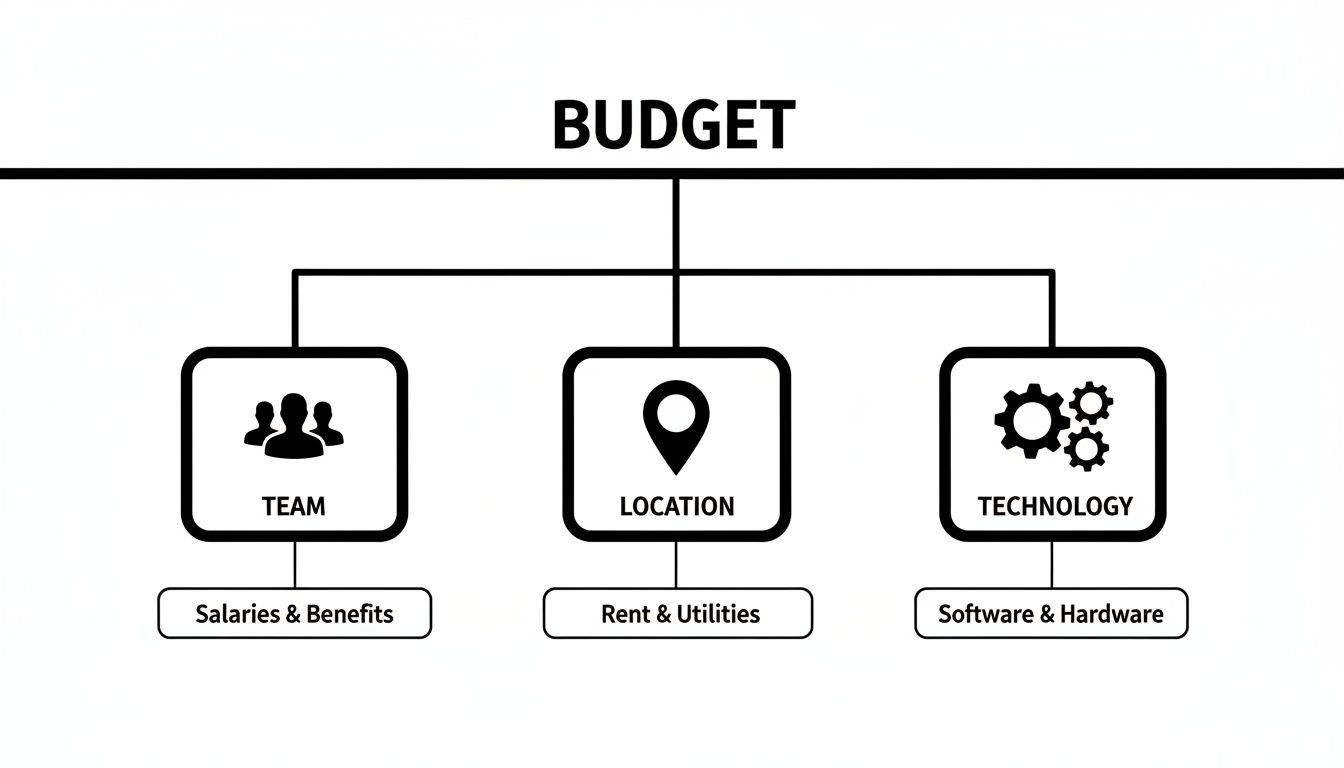

Knowing the high-level cost ranges is a good start, but what truly determines if your project costs $70,000 or surpasses $200,000? The final fintech app development cost is a direct outcome of decisions made in three critical areas: your team composition, their geographic location, and your technology stack.

Mastering these three pillars is essential. They don't just shape your initial budget—they define your app's quality, scalability, and long-term operational costs. Let's dissect each driver to provide the foundational knowledge needed for smarter, more cost-effective decision-making.

The Team That Builds Your Vision

Your development team is the engine of your project, and its composition directly impacts your budget. A high-performing fintech team is a strategic unit of specialists, not just a group of developers. Attempting to cut corners by omitting a key role almost always results in expensive rework and project delays.

A typical high-performing fintech team includes:

- Project Manager (PM): The orchestrator who ensures the project stays on schedule, on budget, and aligned with business goals. The PM is the critical link between stakeholders and the technical team.

- UI/UX Designers: The architects of the user experience. In fintech, trust is the ultimate currency, making their role in creating an intuitive, secure, and valuable interface non-negotiable. A superior UX directly drives user adoption and retention.

- Backend Engineers: The builders of your application's core infrastructure—server logic, databases, and APIs that process transactions and safeguard data. All critical, non-visible functionality is handled here.

- Frontend/Mobile Developers (iOS/Android): These developers translate UI/UX designs into the tangible, functional mobile experience that customers interact with daily.

- Quality Assurance (QA) Engineers: Indispensable in the high-stakes world of finance. They meticulously test the application to identify bugs, security vulnerabilities, and usability issues before they impact users and damage your brand's reputation.

The team's size and seniority level will scale with project complexity, directly influencing the overall cost.

How Location Dramatically Affects Cost

Your team's geographic location is one of the most significant levers for managing your budget. Hourly rates for elite technical talent vary dramatically across the globe, and savvy businesses leverage this to their advantage.

Consider these typical hourly rates for a senior developer:

| Region | Average Hourly Rate (USD) |

|---|---|

| North America | $100 – $250 |

| Western Europe | $70 – $150 |

| Eastern Europe (e.g., Ukraine) | $50 – $80 |

| Asia | $20 – $50 |

In practical terms, a project estimated at $350,000 with a North American team could potentially be delivered for $160,000 or less by an Eastern European team with the same level of expertise.

Strategic Advantage: This is not about finding the lowest price but achieving the highest value. Partnering with a premium offshore team, like the dedicated engineers at Group 107, provides access to world-class talent at a fraction of the cost without compromising on quality, communication, or security. This model can unlock savings of up to 60% on labor costs while accelerating your time-to-market.

Critical Technology Choices

Your technology stack—the collection of programming languages, frameworks, and tools—profoundly impacts both initial development costs and long-term operational expenses.

Key decisions that shape your budget include:

- Native vs. Cross-Platform Development: Building separate native apps for iOS (Swift) and Android (Kotlin) delivers the best performance and user experience but is the most expensive route. Cross-platform frameworks like React Native or Flutter allow for a single codebase for both platforms, potentially cutting development time and costs by up to 40%—an excellent strategy for many MVPs.

- Backend Technologies: The choice of a backend language (e.g., Python, Java, Node.js) and database (e.g., PostgreSQL, MongoDB) influences development speed, scalability, and the availability of skilled developers.

- Cloud Provider: Selecting a provider like Amazon Web Services (AWS), Google Cloud, or Microsoft Azure will determine your ongoing hosting costs and access to specialized tools for security and data analytics, defining your recurring operational expenditure.

These three drivers—team, location, and technology—are interconnected. A clear understanding of how they work together is the key to building a strategic financial plan that aligns with your business goals.

How App Features and Complexity Shape Your Costs

Now that we have covered the high-level budget drivers, let's examine how specific features and overall complexity directly dictate the final fintech app development cost. A simple truth governs this process: not all features are created equal. A basic user authentication flow is worlds apart from an AI-powered fraud detection system in terms of development effort and expense.

Understanding how each layer of functionality impacts your budget is crucial for prioritizing what's essential for launch versus what can be added in later phases. This is where your budget becomes tangible. We will start with the leanest version of your product—the Minimum Viable Product (MVP)—and build up to more sophisticated platforms, illustrating precisely where your investment is allocated.

The diagram below breaks down how your total budget is a direct result of strategic decisions made across three critical pillars: your team, their location, and the tech stack you choose.

Each of these pillars contributes significantly to the final cost, reinforcing that your budget is a product of these interconnected choices.

Starting With a Minimum Viable Product (MVP)

An MVP is not a cheap, unfinished app; it's a strategic tool designed to solve one core user problem with the absolute minimum set of features. This approach gets your product into the hands of real users quickly, allowing you to validate core assumptions and attract investors without exhausting your capital.

For a fintech MVP, the focus is always on the essentials—the engine and chassis of your application.

Business Rationale: A fintech MVP is your fastest path to market validation. By focusing only on core functionality, you minimize initial investment while gathering the crucial user feedback needed to guide future development and secure funding. This lean approach prevents you from building expensive features nobody wants.

Common MVP features and their typical cost breakdown:

- User Registration and Login: Secure onboarding is non-negotiable. This includes basic email/password signup and multi-factor authentication, typically costing $7,000 – $15,000.

- Basic Transaction Processing: The core capability to send or receive money, even if limited initially, is central to most fintech apps. Expect this to be in the $10,000 – $25,000 range.

- Simple User Dashboard: A clean, intuitive interface for users to view their balance, check transaction history, and manage their profile costs around $8,000 – $18,000.

- Essential Security Measures: Foundational data encryption and a secure server setup are vital for earning user trust from day one. This will add $10,000 – $20,000 to the budget.

An MVP with this core feature set typically lands in the $50,000 to $70,000 range and can be built in approximately 3-5 months.

Scaling to a Mid-Tier Application

Once your MVP has proven its market value, the next step is to add features that enrich the user experience and expand the app's capabilities. This phase marks the transition from a proof-of-concept to a competitive product, often requiring the integration of more complex, specialized functions.

A mid-tier fintech app typically costs between $60,000 and $150,000. These applications balance sophistication and cost, incorporating features like secure payment processing, user analytics, and fraud detection. Development can take 4-8 months, requiring 2,300 to 3,200 hours of work.

Key features that define a mid-tier app include:

- Payment Gateway Integration: Connecting with services like Stripe or Braintree to handle real-time payments is essential for monetization. This adds complexity and costs $15,000+.

- KYC/AML Verification: Integrating third-party services for identity verification (Know Your Customer/Anti-Money Laundering) is critical for compliance. This can range from $10,000 to $25,000.

- Biometric Security: Adding Face ID or fingerprint authentication significantly enhances security and user trust, typically costing $5,000 – $10,000.

- User Analytics: Implementing tools to track user behavior enables data-driven decisions for future updates. This usually adds $7,000 – $15,000.

With these additions, a mid-tier app can cost anywhere from $100,000 to $150,000. For a more precise figure based on your specific feature list, our detailed software development cost calculator can provide a clearer estimate.

Building an Enterprise-Grade Solution

Enterprise-level fintech platforms are engineered for massive scale, ironclad security, and complex regulatory environments. The investment is substantial because it's required to support millions of users and sophisticated financial operations for large institutions or public companies.

Features that elevate an app to the enterprise category include:

- AI-Driven Personalization: Using machine learning to offer personalized financial advice, product recommendations, or dynamic risk assessment. This can cost anywhere from $40,000 to $80,000+.

- Advanced Compliance Modules: Building custom systems to adhere to regulations like PSD2, GDPR, and CCPA across multiple jurisdictions is a significant undertaking, often starting at $50,000+.

- Seamless Third-Party Integrations: Creating robust APIs to connect with legacy banking systems, credit bureaus, and other financial data sources is complex, running $30,000 – $60,000.

- Blockchain Integration: For applications requiring decentralized ledgers for enhanced security and transparency, this can range from $30,000 to $100,000+.

The fintech app development cost for an enterprise solution easily surpasses $200,000 and can climb well over $500,000, with development timelines often exceeding nine months.

Feature-Based Cost Estimation for Fintech Apps

To help you visualize how different features impact your budget, we've put together a quick-reference table. While not an exact quote, it provides a solid framework for understanding the relationship between complexity and cost.

| Feature Category | Example Features | Complexity | Estimated Cost Addition (USD) |

|---|---|---|---|

| User Onboarding | Registration, Login, Profile, Password Reset | Low | $7,000 – $15,000 |

| Security & Identity | 2FA, Biometrics (Face/Touch ID), KYC/AML Checks | Medium-High | $15,000 – $35,000 |

| Core Banking | Account Management, Balance View, Transaction History | Medium | $20,000 – $40,000 |

| Payments & Transfers | P2P Transfers, Bill Pay, Payment Gateway Integration | Medium-High | $25,000 – $50,000 |

| User Engagement | Push Notifications, In-App Chat, Support Bots | Low-Medium | $10,000 – $25,000 |

| Analytics & Reporting | User Dashboard, Spending Analysis, Custom Reports | Medium | $15,000 – $30,000 |

| Advanced Tech | AI/ML Fraud Detection, Blockchain, Personalization Engine | High | $40,000 – $100,000+ |

As illustrated, the investment required for advanced features like AI-driven analytics is significantly higher than for basic onboarding. Prioritizing these features within your MVP strategy is the most effective way to manage your budget and build a product that scales with your user base.

Budgeting for Essential Security and Compliance

In fintech, security and compliance are not optional add-ons; they are the bedrock of your product. Attempting to build a financial application without properly budgeting for these elements is akin to constructing a bank without a vault.

These non-negotiable components constitute a significant portion of your fintech app development cost. They are fundamental to building user trust and securing your legal right to operate. Cutting corners here is not just risky—it's a direct threat to your business's viability. Security and compliance must be woven into your app's DNA from the very first line of code.

Navigating the Regulatory Maze

The regulatory landscape is a minefield, with each framework adding layers of cost and technical complexity. Non-compliance can lead to catastrophic fines—up to 4% of global annual revenue for GDPR violations—and irreparable brand damage.

Key regulations that will shape your budget include:

- PCI DSS (Payment Card Industry Data Security Standard): Non-negotiable if your app processes card payments. Annual certification can cost from $5,000 to over $50,000, depending on transaction volume and system complexity.

- GDPR/CCPA (General Data Protection Regulation/California Consumer Privacy Act): Essential for serving users in Europe or California. Initial implementation of data mapping and consent management can add $10,000 to $20,000 to your upfront costs.

- KYC/AML (Know Your Customer/Anti-Money Laundering): These protocols are your frontline defense against fraud. Integrating third-party verification services typically costs $10,000 to $25,000 for setup, plus ongoing per-verification fees.

To manage these ongoing costs, leading teams are integrating compliance process automation directly into their development lifecycle.

Investing in Ironclad Security Measures

Beyond regulatory adherence, you must invest in robust technical security to protect sensitive financial data. Users will not engage with an application they do not trust. This spending is a direct investment in user acquisition and retention.

The average cost of a single data breach is $4.45 million. Viewed through this lens, proactive security investment delivers an extremely high return.

Key security measures to factor into your budget:

- End-to-End Data Encryption: The baseline for protecting data at rest and in transit.

- Multi-Factor Authentication (MFA): A critical security layer that drastically reduces unauthorized access. Integrating SMS, email, or app-based MFA can cost $15,000+.

- Regular Penetration Testing: Hiring ethical hackers to identify and remediate vulnerabilities before they can be exploited. These audits typically cost between $5,000 and $30,000 per engagement.

- Third-Party Security Audits: Independent validation of your security posture is vital for building trust with partners and enterprise clients.

Expert Insight: Security is not a one-time task but a continuous process of vigilance. Building a secure architecture requires a deep understanding of current threats. Learn more in our guide on the best data security technologies to avert cyber threats.

The costs associated with security and compliance are foundational. Partnering with a team like Group 107, which has deep experience in building secure and compliant fintech platforms, ensures these critical elements are integrated efficiently from day one, protecting your business and building the customer trust necessary for success.

Planning for Post-Launch Maintenance and Scaling

Launching your fintech app is not the finish line; it's the starting line. While the initial fintech app development cost is a significant investment, the ongoing expenses for maintenance, security, and scaling will determine your platform's long-term success. Overlooking these post-launch costs is a common and often fatal mistake.

Think of your app as a new vehicle. The purchase price is only the beginning; you must also budget for fuel, maintenance, and insurance. These recurring costs are not optional—they are essential for keeping your investment running smoothly and securely.

Understanding Recurring Operational Costs

Post-launch, your budget must shift from one-time development costs to recurring operational expenses. These are the costs that keep your application online, secure, and available to users 24/7. Proactive planning is the only way to avoid disruptive financial surprises and potential service outages.

Key recurring costs to budget for:

- Server and Hosting: Your digital real estate. Whether using AWS, Azure, or Google Cloud, you will pay for the infrastructure powering your app. These costs scale with your user base, often ranging from $1,000 to $5,000+ per month for an application with significant traction.

- Third-Party API Subscriptions: Your app relies on external services. KYC checks, payment processing (e.g., Stripe), and market data feeds all have monthly or per-transaction fees that can amount to hundreds or thousands of dollars each month.

- Software Updates and Bug Fixes: Technology is constantly evolving. You will need to release regular updates to patch security vulnerabilities, maintain compatibility with the latest iOS and Android versions, and resolve user-reported bugs.

Financial Planning: A reliable rule of thumb is to budget 15-20% of your initial development cost for annual maintenance. For an app with an initial build cost of $150,000, this means allocating $22,500 to $30,000 each year just for upkeep.

Budgeting for Strategic Growth and Scaling

Maintenance keeps you operational, but strategic growth is how you win the market. Your budget must fund the evolution of your product based on user feedback, market trends, and new business opportunities.

Scaling is more than just adding server capacity. It's a strategic process:

- Adding New Features: User feedback is your roadmap. Budgeting to build the features your customers are asking for is a direct investment in retention and competitive differentiation.

- Performance Optimization: An architecture that works for 1,000 users may fail under the load of 100,000. You will need to invest in backend optimization, database tuning, and infrastructure upgrades to maintain performance.

- Adapting to Regulations: The fintech regulatory landscape is dynamic. New laws can emerge, requiring significant development work to ensure ongoing compliance.

Working with a dedicated team like Group 107 provides the continuity and deep product knowledge required to navigate this journey. We build partnerships that extend beyond launch, helping you plan for growth cycles and ensure your platform is engineered for long-term success.

Smart Strategies to Optimize Your Development Budget

Controlling your fintech app development cost does not mean compromising on quality or security. It requires making strategic, informed decisions from day one to maximize the value of every dollar spent. A disciplined approach, focused on ruthless prioritization and smart partnerships, allows you to launch a powerful product without budget overruns.

Start Lean with a Focused MVP

The single most effective budget optimization strategy is launching a Minimum Viable Product (MVP). An MVP is not a cheap prototype; it's a laser-focused release that includes only the essential features needed to solve one core problem for your target users. This approach enables rapid market validation and gathers real-world feedback quickly.

Developing a basic fintech MVP typically falls within the $20,000 to $50,000 range, covering essential functionalities like user authentication, transaction logging, and a clean UI/UX. This focused scope allows for a market launch in just 2-4 months. You can gain further insight into this phase by reviewing a detailed fintech development cost overview.

Adopting an agile workflow is also critical. Instead of being locked into a rigid, long-term plan, agile development allows you to pivot based on MVP feedback, ensuring you invest only in features that deliver tangible user value.

Leverage Smart Technology and Partnerships

Your choice of technology and team structure are major cost drivers. Using open-source technologies can eliminate licensing fees, while a cross-platform framework can reduce development time and expenses by up to 40%. For simpler projects, exploring no-code app development platforms can be a viable way to launch an initial version quickly and with minimal investment.

However, the most impactful strategy is partnering with a premium offshore team. This approach unlocks several key advantages:

- Significant Cost Savings: Gain access to world-class engineers at a fraction of North American rates, often reducing labor costs by up to 60%.

- Dedicated Expertise: Work with a team 100% committed to your project, acting as a seamless extension of your company without competing priorities.

- Strong IP Protection: A reputable partner ensures your intellectual property is secure, providing full transparency and control throughout the development process.

By combining a lean MVP strategy with a smart offshore partnership, like the model offered by Group 107, you can build a secure, scalable, and successful fintech application while maintaining strict budgetary control.

Common Questions Answered

Budgeting for a new financial application can be complex. To provide greater clarity, we've answered some of the most common questions about the real cost of fintech app development.

Why Is Fintech App Development More Expensive Than Other Apps?

The higher cost of fintech app development is driven by three non-negotiable requirements: ironclad security, complex regulatory compliance, and sophisticated third-party integrations. Financial applications must adhere to stringent regulations like PCI DSS and GDPR, meaning high-level security cannot be an afterthought—it must be integrated from day one.

Unlike a standard e-commerce app, a fintech platform handles users' most sensitive financial data. This necessitates robust encryption, advanced fraud detection algorithms, and secure integrations with banking systems. This inherent complexity increases development and testing time, which directly drives up the final cost.

How Much Do AI Features Add to the Cost?

Integrating intelligent features like a robo-advisor, predictive analytics, or an AI-powered fraud detection engine is a powerful differentiator, but it significantly impacts the budget. As a general rule, incorporating AI or machine learning will typically add 20-40% to your total development cost.

An AI-powered project often starts at around $150,000 for an MVP and can easily exceed $300,000. The final cost depends on the complexity of the AI models, the volume of data required for training, and the specialized talent needed to implement the algorithms effectively.

What Is the Most Cost-Effective Development Region?

Your team's location is one of the largest controllable factors in your budget. Developers in North America typically charge $100-$250 per hour. In contrast, highly skilled engineers in Central and Eastern Europe are available for $50-$85 per hour.

This discrepancy can translate into substantial savings—potentially reducing your development costs by up to 50% without sacrificing quality. This is a proven strategy used by many successful fintech startups, who partner with top-tier offshore teams to access world-class talent at a more sustainable price point.

Ready to build a secure, scalable fintech platform with a team that understands the market? Group 107 provides dedicated offshore engineering teams to help you launch faster and more cost-effectively.