An open banking API integration is the secure technical connection that allows fintech applications to access customer financial data from banks and other institutions, but only with explicit user consent. This standardized API-driven handshake is the engine behind a new generation of financial services, enabling everything from automated accounting and intelligent budgeting tools to seamless payment systems. The core objective is to dismantle data silos and foster a more competitive, user-centric financial ecosystem.

Why Open Banking API Integration Is a Competitive Edge

Executing an open banking API integration is no longer a matter of simple regulatory compliance; it has become a central strategic pillar for any fintech, SaaS platform, or enterprise serious about innovation. It is a powerful driver for product development, operational efficiency, and creating superior user experiences that build customer loyalty.

This approach represents a fundamental shift away from the legacy model where financial data was locked within the vaults of individual banks. Open banking liberates this data, empowering developers to build applications that solve tangible financial challenges for both consumers and businesses.

Unlocking New Revenue Streams and User Value

A well-architected open banking API integration creates new value by enabling features that were previously too complex or impossible to implement. Secure access to financial data unlocks a wide range of product opportunities.

Key business impacts include:

- Hyper-Personalized Financial Tools: Access to transaction history and account balances allows you to offer tailored financial advice, automated savings plans, or predictive cash flow analysis for small businesses. For example, a SaaS accounting platform can use real-time data to provide a small business with actionable insights on managing their cash flow.

- Automated Financial Workflows: An accounting platform can automatically fetch and reconcile bank transactions with invoices, eliminating hours of manual data entry and reducing human error. This delivers a direct ROI by freeing up valuable employee time.

- Seamless Embedded Finance Experiences: You can integrate payment initiation directly into an e-commerce checkout flow or enable instant income verification for in-app loan applications, removing friction and improving conversion rates.

The market adoption is accelerating. Global open banking API call volumes are projected to reach 720 billion by 2029, a massive 427% increase from 2025. This growth signals a widespread business shift toward this infrastructure. You can read the full research on this market expansion to grasp the scale of the opportunity.

Core Capabilities Driving Innovation

The open banking ecosystem, largely defined by regulations like Europe's PSD2, is built around two key service provider roles. Understanding these is essential for planning your integration strategy.

Account Information Service Providers (AISP)

An AISP is a licensed third-party that, with user consent, aggregates account information from one or more financial institutions. This "read-only" access is the foundation for services such as:

- Personal finance management (PFM) applications that consolidate all of a user's accounts into a single dashboard.

- Advanced credit scoring models that leverage real-time transaction data for more accurate risk assessment.

- Accounting software that automatically syncs bank feeds into a company’s general ledger.

Payment Initiation Service Providers (PISP)

A PISP initiates payments directly from a user's bank account on their behalf, bypassing traditional card networks. This "write" access can significantly reduce transaction fees and streamline the payment process. PISP capabilities power:

- Direct account-to-account payments within an e-commerce checkout.

- Centralized bill payment services that allow users to manage all their recurring payments from a single app.

- Digital wallet top-ups or peer-to-peer transfers without requiring credit card details.

Structuring your open banking API integration around these AISP and PISP capabilities positions your business not just to compete, but to lead. It is the most direct path to building a differentiated product and delivering the frictionless financial experiences users now demand.

Designing a Resilient Integration Architecture

The success of any open banking API integration depends entirely on its architectural foundation. A poorly designed system creates scalability bottlenecks, security vulnerabilities, and a maintenance nightmare. A well-designed architecture, however, provides a reliable and scalable platform that supports business growth.

The first critical architectural decision is choosing how to connect to the banking ecosystem. This choice will fundamentally impact your development timeline, operational overhead, and speed to market.

Direct Integration vs. API Aggregators: The Build-vs-Buy Decision

Choosing between building direct connections to each bank and using a third-party API aggregator is a classic build-versus-buy scenario. Each path has significant trade-offs related to speed, cost, and control.

- A direct integration involves connecting to each financial institution’s API individually. This approach provides maximum control over the data flow and user experience but requires a massive engineering investment to build, certify, and maintain each unique connection.

- An API aggregator (e.g., Plaid, Tink) acts as an intermediary. You integrate with their single, unified API, and they manage the connections to hundreds or thousands of individual banks. This dramatically reduces time-to-market but introduces dependency on a third-party provider and often involves transaction-based fees.

The optimal choice depends on your business model. An early-stage startup needing to validate a product quickly will benefit from an aggregator's speed. In contrast, a large enterprise with specific security and performance requirements may prefer the control offered by direct integrations. Reviewing how various types of integrations are structured can provide a broader perspective for your open banking strategy.

Comparing Integration Approaches: A Framework for Decision-Making

This table breaks down the key factors to consider when choosing between a direct integration and an API aggregator for your open banking needs.

| Factor | Direct Bank Integration | API Aggregator |

|---|---|---|

| Development Speed | Slow. Requires building and maintaining dozens of unique integrations. | Fast. A single integration provides access to a wide network of banks. |

| Upfront Cost | High. Significant engineering resources are needed for development. | Low. Minimal initial development effort is required to get started. |

| Long-Term Cost | Lower operational cost once built, but high maintenance overhead. | Potentially high due to per-transaction or per-user fees at scale. |

| Control & Customization | Full control over the user experience, data flow, and error handling. | Limited. You are constrained by the aggregator’s features and UI. |

| Coverage | Limited to the specific banks you choose to integrate with. | Broad. Instantly gain access to the aggregator's entire network. |

| Maintenance | High. You are responsible for every API update and change. | Low. The aggregator handles all bank-side maintenance and updates. |

Ultimately, the decision must align with your available resources, project timeline, and long-term strategic goals.

Selecting a Scalable Technology Stack

Your internal technology stack is as critical as your connection strategy. A modern, scalable architecture is essential for handling high transaction volumes and ensuring reliability.

- Microservices Architecture: This has become the de facto standard for complex financial applications. By breaking the system into smaller, independent services (e.g., user authentication, consent management, payment processing), you can develop, deploy, and scale each component separately. This design improves resilience, as a failure in one service does not necessarily bring down the entire system. For a deeper dive, explore our guide on 10 essential microservices architecture best practices.

- Serverless Functions: Use serverless functions for specific, event-driven tasks like processing webhook notifications from banks or running asynchronous data jobs. This approach reduces operational overhead and can be highly cost-effective, as you only pay for the compute time you use.

- Secure Data Vault: You must implement a secure, isolated system for storing sensitive credentials like access and refresh tokens. This vault should have strict access controls, strong encryption at rest, and detailed audit logs. Never store sensitive credentials in your primary application database. Security must be an architectural principle from day one.

Mastering Security and Regulatory Compliance

In fintech, trust is the ultimate currency, built on two pillars: airtight security and strict regulatory adherence. For an open banking API integration, these are non-negotiable requirements. A single vulnerability can destroy user confidence and lead to severe legal and financial repercussions.

Effective security requires a defense-in-depth strategy that protects customer data at every stage: in transit, at rest, and during processing. This is where your architecture, authorization flows, and compliance frameworks must work in perfect concert.

Implementing Secure Authorization with OAuth 2.0 and PKCE

The OAuth 2.0 authorization framework is the industry standard for securing open banking APIs. It enables third-party applications to gain limited, consent-based access to a user's bank account without ever handling their login credentials.

However, the standard OAuth 2.0 flow can be vulnerable to authorization code interception attacks, especially in public clients like mobile or single-page web applications. Proof Key for Code Exchange (PKCE) is an extension that mitigates this risk.

Here is how PKCE enhances security:

- Your application generates a secret string (

code_verifier) and a transformed version (code_challenge). - When redirecting the user to their bank, the application sends the

code_challenge. - After the user authenticates and provides consent, the bank redirects them back with an authorization code.

- To exchange the code for an access token, your application sends both the authorization code and the original secret

code_verifier. - The bank's server performs the same transformation on the received

code_verifier. If it matches thecode_challengefrom the initial request, it issues the access token.

This process ensures that even if an attacker intercepts the authorization code, it is useless without the secret code_verifier.

Navigating Consent and Regulatory Frameworks

Compliance is about demonstrating to users and regulators that you are a responsible custodian of sensitive financial data. In Europe, the Second Payment Services Directive (PSD2) sets the standard.

A key component of PSD2 is Strong Customer Authentication (SCA), which requires authentication to use at least two of the following three factors:

- Knowledge: Something only the user knows (e.g., a password).

- Possession: Something only the user has (e.g., their phone, verified with a one-time code).

- Inherence: Something the user is (e.g., a fingerprint or facial scan).

Your integration must be designed to handle these multi-factor authentication flows. Furthermore, consent management is an ongoing process. Users must have a clear and simple way to view and revoke permissions at any time. A transparent consent dashboard is essential for building and maintaining user trust. While not always a direct requirement, understanding frameworks like PCI DSS can provide valuable insights. You can learn more in this comprehensive guide to PCI DSS Compliance.

Hardening Your API Endpoints

Beyond authorization, your API endpoints must be hardened against attack. A defense-in-depth strategy is crucial here. For a detailed breakdown, review our guide on the 10 essential REST API security best practices for 2025.

Key security measures include:

- Data Encryption: Encrypt all data in transit using TLS 1.2 or higher. Encrypt sensitive data at rest, including access tokens and user credentials stored in your database.

- Secure Key Management: Never hardcode cryptographic keys. Store them in a secure, dedicated system like a Hardware Security Module (HSM) or a cloud service such as AWS KMS or Azure Key Vault.

- Input Validation: Treat all incoming data as potentially malicious. Rigorous validation of all inputs is your best defense against injection attacks like SQLi and XSS.

- Rate Limiting and Throttling: Implement strict rate limits to protect your services from Denial-of-Service (DoS) attacks and prevent abuse.

By embedding these security and compliance principles into every layer of your open banking API integration, you build a system that is not only functional but also resilient and trustworthy.

Your Integration Roadmap: From Sandbox to Production

Moving an open banking API integration from concept to a live, production system is a deliberate, multi-stage process. A structured approach ensures a faster, more reliable launch with fewer complications. This journey progresses from a controlled, simulated environment to real-world financial transactions, with each phase building upon the last.

Step 1: Bulletproof Your Logic in the Sandbox

The sandbox environment is your most critical proving ground. Provided by banks and API aggregators, these isolated environments allow you to test your integration against a replica of their production API without using real customer data. It is a flight simulator for your code, designed to let you fail safely and learn before real money is at stake.

Effective sandbox testing goes beyond verifying "200 OK" responses. You must simulate a wide range of scenarios to ensure your application logic and error handling are robust.

A comprehensive testing checklist includes:

- Successful Flow ("Happy Path"): Execute the complete flow for both data retrieval (AISP) and payment initiation (PISP), including the full OAuth 2.0 and consent journey.

- Common Failure Scenarios: Intentionally trigger errors. Test for incorrect passwords, insufficient funds, and other user-driven issues. Simulate

4xxand5xxAPI errors to ensure your system fails gracefully. - Consent Lifecycle Management: Test the full lifecycle of user consent. Verify that your application immediately recognizes and honors a user's decision to revoke consent via their banking app.

Thorough sandbox testing is the most cost-effective insurance against production failures. The more edge cases you identify and resolve here, the smoother your launch will be.

Step 2: Core Development and API Interaction

After validating your logic in the sandbox, you can proceed with core development. This phase involves writing the code that makes live API calls to fetch data or initiate payments. While the implementation details will vary based on your tech stack, the fundamental API interactions are generally consistent.

For example, a conceptual Node.js snippet for fetching account data after obtaining an access token might look like this:

// This is a simplified, conceptual example.

const axios = require('axios');

async function getAccountData(accessToken, bankApiUrl) {

try {

const response = await axios.get(`${bankApiUrl}/accounts`, {

headers: {

'Authorization': `Bearer ${accessToken}`,

'Accept': 'application/json'

}

});

// Process the account data from response.data

console.log('Successfully retrieved account data:', response.data);

return response.data;

} catch (error) {

// Implement robust error handling for failed API calls

console.error('Failed to fetch account data:', error.response.data);

throw new Error('Could not retrieve accounts.');

}

}

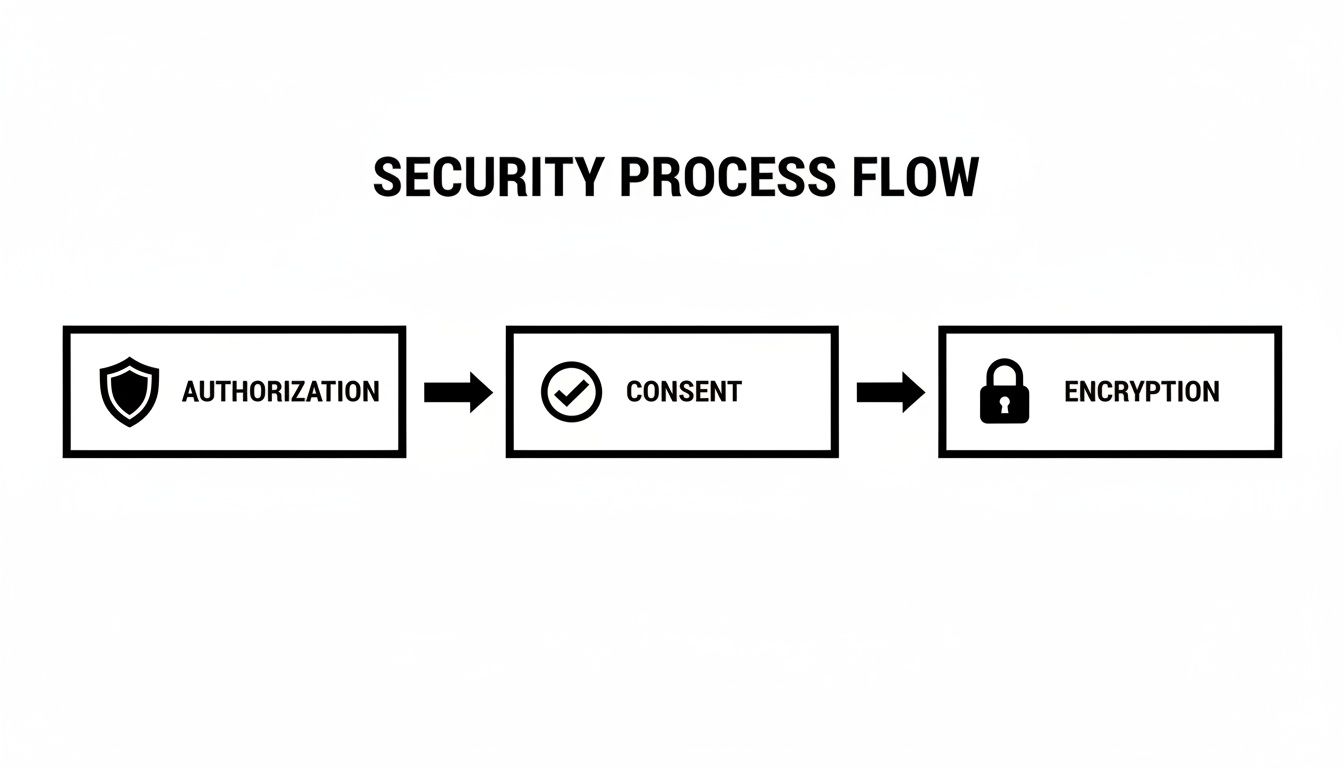

A production-ready system requires more than this, including comprehensive error handling, request signing, and secure token storage. The entire flow depends on the seamless interplay of authorization, consent, and encryption.

This diagram illustrates how these security processes work together at a high level.

Each step, from user authorization to connection encryption, is a critical link in the chain that protects sensitive financial data.

Step 3: Navigating the Go-Live Process

Transitioning to production is the final and often most administratively intensive phase. This is where your code meets the strict security and regulatory requirements of the real world. Expect a thorough onboarding and validation process with each bank you connect to.

Key steps for going live include:

- Configure a Production Environment: Set up your production servers, databases, and network with hardened security, including firewalls, secure key vaults, and robust logging.

- Obtain eIDAS Certificates: For operations in the UK and EU, you must acquire qualified eIDAS certificates (QWACs and QSEALs) to identify your application to banks and secure the connection.

- Onboard with Each Bank: Every financial institution has a unique onboarding process. You will need to submit your application for review, provide your certificates, and demonstrate that your integration meets their security and technical standards. This can be a lengthy process, so factor it into your project timeline.

Successfully navigating this roadmap positions your business at the forefront of a major industry transformation. The open banking market is projected to grow from $33.1 billion in 2025 to $161.5 billion by 2034, evolving from a compliance exercise to a core driver of business value. You can discover more insights about open banking's commercial growth to understand the market trajectory. A well-executed production launch is your entry ticket to this financial evolution.

How to Test and Monitor Your Integration for Reliability

Deploying your open banking API integration to production is a significant achievement, but it marks the beginning of a continuous process of ensuring reliability and performance. An unreliable system erodes user trust and creates operational burdens. The focus must shift from development to maintaining a system that is always available, fast, and accurate.

A robust testing strategy is your first line of defense, simulating real-world conditions to identify and resolve issues before they impact customers.

Building a Multi-Layered Testing Strategy

To ensure system resilience, you need a comprehensive testing approach that validates every component, from individual functions to the complete end-to-end user journey.

- Integration Testing: Verifies that different components of your application, such as your consent management module and your API connector, work together correctly. The goal is to identify issues at the intersection of services.

- End-to-End (E2E) Testing: Simulates a complete user workflow from start to finish. For example, an automated test might mimic a user logging in, linking a bank account, and initiating a payment.

- Performance and Load Testing: Assesses how your system performs under stress by simulating thousands of concurrent users or API calls. This helps identify performance bottlenecks and breaking points before they occur in production.

A critical but often overlooked test case is simulating bank API outages. Your system must be designed to handle these failures gracefully by queuing requests and recovering seamlessly once the service is restored.

Designing for Failure with Robust Error Handling

In the distributed ecosystem of open banking, failures are inevitable. Bank APIs will experience downtime, return inconsistent data, or enforce rate limits. A resilient integration anticipates these issues and is designed to handle them without disrupting the user experience.

Your error-handling logic must be sophisticated enough to differentiate between various failure types and respond appropriately.

Key Scenarios to Handle:

- API Downtime: Implement a circuit breaker pattern to temporarily halt requests to a failing service, preventing cascading failures. Combine this with an exponential backoff strategy for retrying requests.

- Inconsistent Data: Design your data parsing layer to be flexible and include strong validation to handle missing fields or unexpected values without crashing.

- Rate Limiting: When you receive a

429 Too Many Requestsresponse, your system should automatically pause and retry after the period specified in the API's response headers.

Building resilient and secure systems requires specialized expertise. The team at Group107 Digital offers DevOps as a Service solutions to help you implement these best practices correctly from the start.

Proactive Monitoring and Alerting

You cannot fix problems you cannot see. Effective monitoring requires a proactive approach, using tools like Datadog, Prometheus, or New Relic to gain real-time visibility into the health of your open banking API integration.

Track key performance indicators (KPIs) that directly reflect the user experience:

- API Latency: Monitor the response times of bank APIs. A sudden spike can indicate network issues or problems on the bank's side.

- Error Rates: Track the percentage of failed API calls (e.g.,

4xxand5xxerrors). An increasing error rate signals a problem. - Transaction Success Rate: For PISP flows, monitor the percentage of successful payments. A dip could indicate issues with SCA flows or bank-side processing.

By setting up intelligent alerts based on these metrics, your team can be notified of issues immediately, allowing you to resolve them before they impact a significant number of users and maintain a trustworthy service.

The Future: Monetization, Open Finance, and AI

A stable and reliable open banking API integration is not the end goal; it is the foundation for future innovation and commercialization. With the technical infrastructure in place, the focus shifts to creating business value and staying ahead of industry trends. The initial phase of open banking, driven by regulatory compliance, is over. We are now in an era of commercialization, where the value of connected financial data is being unlocked through innovative business models.

New Frontiers in Monetization

A robust integration creates numerous opportunities for revenue generation that extend beyond your core product offering. The true value lies in the insights and services you build on top of the data.

Leading companies are exploring several key models:

- Premium Data Analytics: Offer businesses advanced analytics dashboards that provide predictive cash flow analysis, customer spending insights, or real-time fraud detection scores—all derived from aggregated open banking data.

- Variable Recurring Payments (VRPs): This transformative technology enables recurring payments for varying amounts, providing a more flexible alternative to traditional Direct Debits. It is ideal for usage-based subscription models, utility billing, or "sweep" services that automatically optimize a user's accounts.

- Embedded Finance as a Service: Leverage your open banking capabilities to power an embedded finance strategy. Enable non-financial platforms, such as e-commerce sites or SaaS tools, to offer financial products like point-of-sale lending or automated invoicing directly within their applications.

Treat your integration as a platform—a technical asset upon which you can build new, high-margin services, turning a cost center into a revenue driver.

The Shift Toward Open Finance

The natural evolution of open banking is Open Finance, which expands the scope of data sharing to include a user's entire financial life—investments, pensions, insurance, mortgages, and more. A flexible open banking API integration built today will position you to lead in this next wave. With a richer dataset, you can develop truly holistic financial management tools, such as an application that provides comprehensive, automated retirement advice by analyzing a user's pension contributions, investment performance, and spending habits.

AI and Machine Learning: The Intelligence Layer

The ultimate goal is to apply artificial intelligence and machine learning to this vast amount of data. AI can transform raw transactions into predictive, hyper-personalized insights that provide real value to your customers by identifying patterns that are impossible for humans to detect.

This unlocks powerful capabilities:

- Hyper-Personalization: Deliver product recommendations, savings tips, and financial advice that are tailored to an individual’s unique financial behavior.

- Predictive Insights: Forecast a user's future cash flow, identify early signs of financial distress, or detect sophisticated fraud patterns in real-time.

- Automated Financial Assistants: Develop AI-powered agents that can manage budgets, optimize investments, and proactively handle financial tasks on behalf of a user.

Open banking is fundamentally reshaping global finance. Embedded finance is already a $104.8 billion market in 2024 and is projected to reach $834 billion by 2034. The winners will be those who effectively combine open banking APIs with an intelligent AI layer to create indispensable user experiences. Understanding the key trends defining fintech opportunities will ensure that the integration you build today is ready for the demands of tomorrow.

Summary and Next Steps

An open banking API integration is a strategic imperative for any business looking to innovate in the financial services sector. A successful integration requires a resilient architecture, rigorous security and compliance, and a forward-thinking approach to monetization.

Your actionable next steps are:

- Define Your Strategy: Choose between a direct integration and an API aggregator based on your business goals, resources, and timeline.

- Prioritize Security: Implement OAuth 2.0 with PKCE, establish robust consent management, and harden your API endpoints from day one.

- Build and Test Methodically: Use a structured roadmap, starting with thorough sandbox testing and progressing to a carefully managed production launch.

- Monitor and Iterate: Implement proactive monitoring and alerting to ensure long-term reliability and continuously look for opportunities to leverage your integration for new value creation.

At Group107, we specialize in building secure, scalable, and user-centric fintech platforms. Contact us to discuss how our dedicated engineering teams can help you build your next financial innovation.